The lack of credit facilities and safety nets make small and medium enterprises (SMEs) "vulnerable” to disasters, according to state-owned think tank Philippine Institute for Development Studies (PIDS).

PIDS senior research fellow Marife Ballesteros said in a presentation at the recent 2015 Apec Study Centers Consortium Conference that disasters can compromise capital, supply chains, product markets and labor, as well as business continuity and recovery.

"SMES are more vulnerable [than large enterprises] because they have limited coping mechanisms. SMEs usually have no or limited disaster insurance and limited access to credit, and most of them have no business continuity, emergency management, or disaster-preparedness plans,” Ballesteros said.

Ballesteros pointed out the insufficient recovery funds for farm-based and urban-based small industries, such as the availability of loan and grant for these businesses.

Another issue highlighted by Ballesteros is the absence of specific policies for workers’ protection in times of calamities. She emphasized the importance of the people side of business during disaster.

"Resilient supply chain begins with resilient citizens and employees and it is a concern of both business and the government,” she stated.

Ballesteros cited the case of the Philippines, where approximately 98 percent of all enterprises are micro to small.

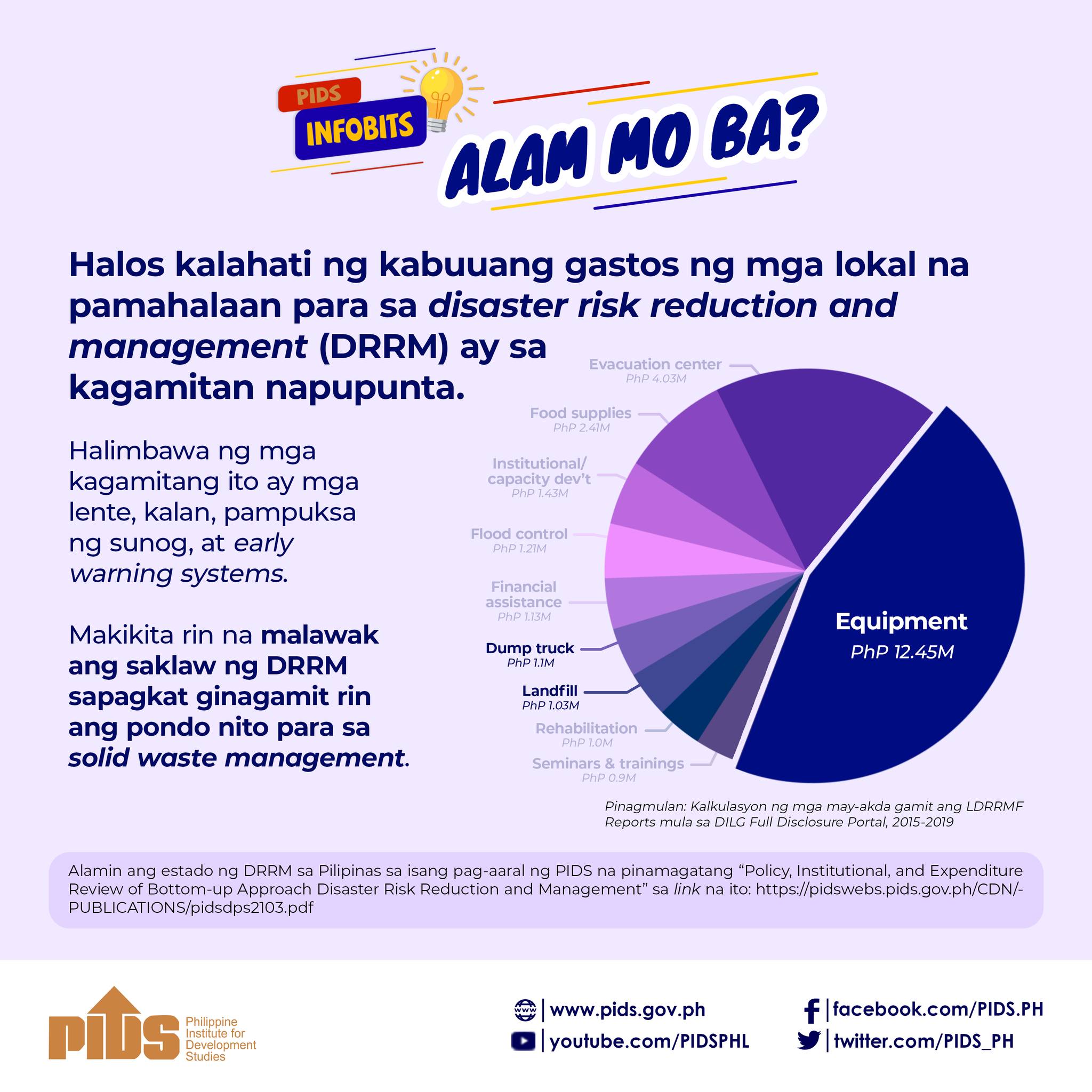

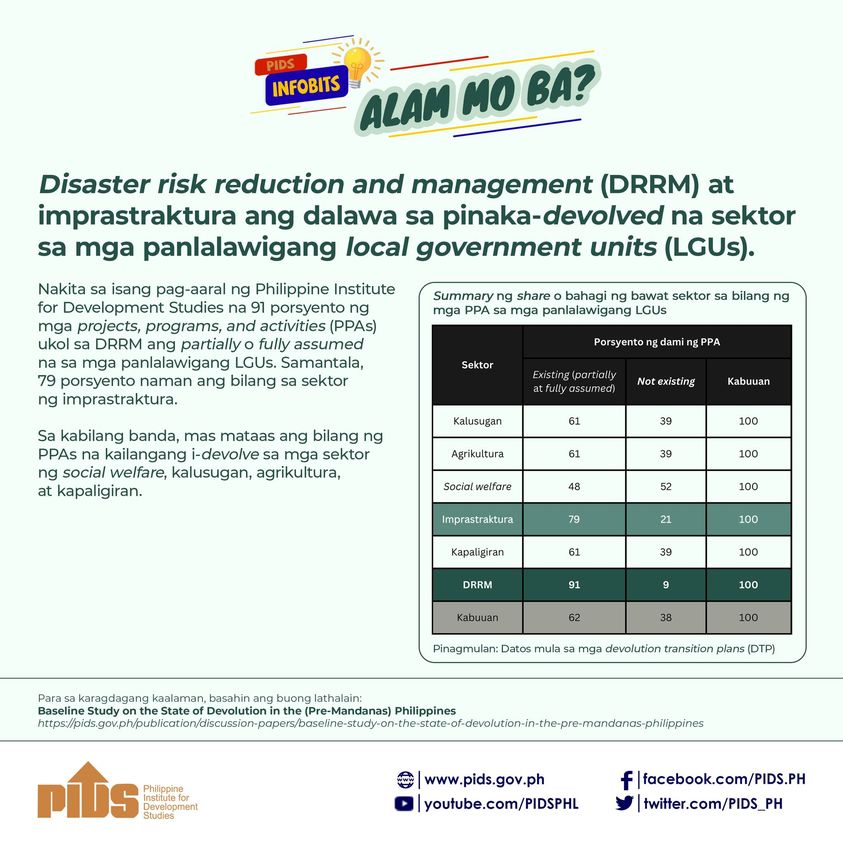

She noted that the country has a well-developed policy framework and action plans for disaster-risk reduction and management (DRRM). However, this disaster-response strategy has not been effectively translated into local and business plans.

To address these problems, Ballestros recommended the establishment of key transport hubs and strategic communication systems that take into consideration extreme weather events. She also highlighted the need for predisaster agreements as disruption of public sector operations and services can occur during times of calamities.

One of these is the creation of networks or partnerships between national and local, and public and private entities, and the adoption of flexible regulations on labor, as well as laws on importation and exportation.

In addition, the government must support the development of financial security instruments such as catastrophic insurance, micro insurance, or a business-disaster fund.

She also suggested the integration of DRRM in the Magna Carta for SMEs and Barangay Micro Business Enterprises, as well as in the MSME Development Plan.

"SMEs should continue to build partnerships with other multinational organizations inside and outside of the Apec region, especially in the areas of information sharing and promotion of regional resiliency-assessment programs,” Ballesteros said.

"Apec member-economies can also have dialogues, capacity-building activities, and cross collaboration in resource and technology sharing, such as in hazard mapping and information-technology infrastructure,” she added.

Over 97 percent of businesses in Apec are SMEs, providing jobs to more than half of the workers in the Asia-Pacific region. However, Apec member-countries are prone to intense natural disasters.

Apec’s 21 member-economies, which account for 52 percent of the earth’s surface and 59 percent of the world’s population, experience over 70 percent of global natural disasters.

The Apec Study Centers Consortium Conference 2015 was held on May 12 and 13 in Boracay, Aklan Province, as part of the Second Senior Officials Meeting and Related Meetings of Apec 2015.//