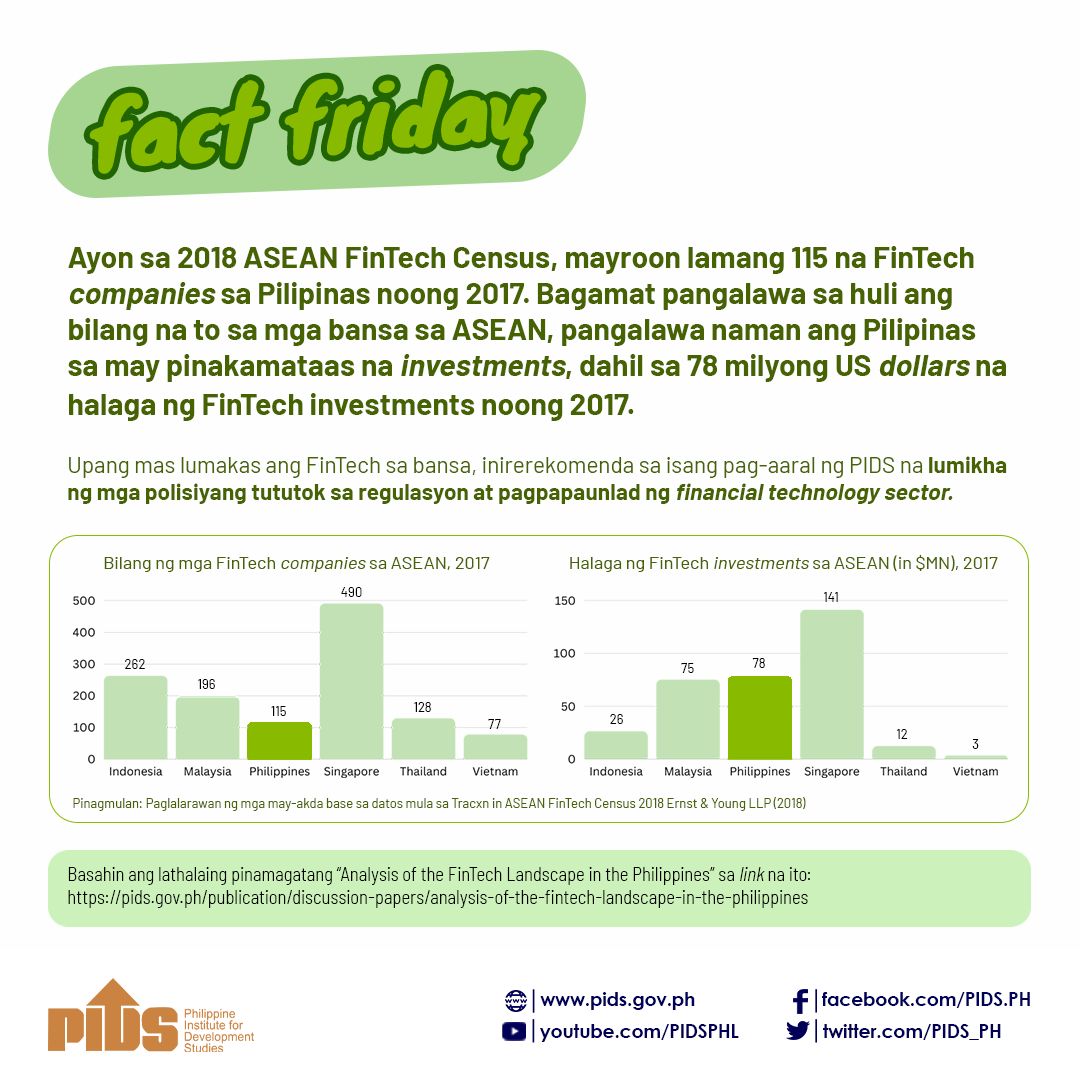

The Philippines’ financial services sector remains one of the lowest among other Asean member states, according to a study made by state-owned think tank Philippine Institute for Development Studies (PIDS).

Data from PIDS indicated that the Philippines ranked seventh in terms of ratio of banking assets to gross domestic product and sixth in terms of banking assets per capita.

The country also had the smallest life and non-life insurance markets both in terms of assets and premiums among the Asean-5 composed of the Philippines, Indonesia, Malaysia, Singapore and Thailand. Both markets are dominated by Singapore.

"Even our largest banks are small compared to the smallest banks of other Asean member states,” Mario Lamberte, team leader of Component 3 of the Advancing Philippine Competitiveness (COMPETE) project said in a forum recently.

The study showed that Banco de Oro, the largest bank in the country, has a total assets and deposits of $68 billion in 2013.

However, the bank is still small compared to the third largest bank of Indonesia, Bank Central Asia, with a total of 75 billion dollars assets and deposits in the same year.

"There must be something wrong in our financial system because it doesn’t contribute much to our economy,” Lamberte said.

The study suggests to unlock the power of the banking system to perform in financial intermediation function, continue the liberalization of the financial system by encouraging more foreign players to enter the domestic financial market, combine liberalization policy with a strong merger and consolidation policy, and introduce measures to support small and medium enterprises to scale up their operations.

COMPETE is a USAID-Philippines project under the Partnership for Growth, a White House initiative.

The project aims to expand access to credit for small and medium enterprises particularly through an improved system of credit information for SME lending, wider utilization of credit guarantees, and overall stronger borrowing capacity for entrepreneurs. //