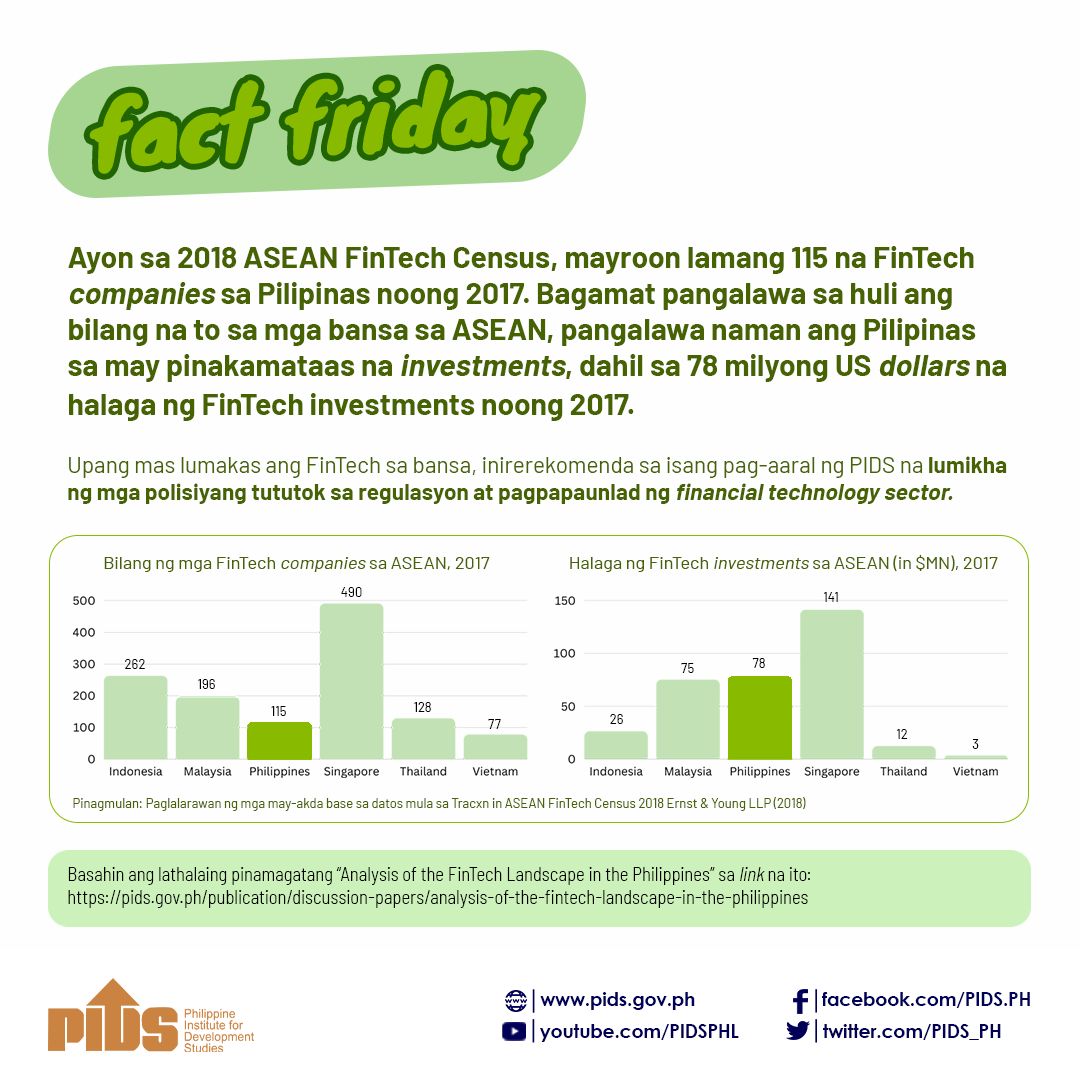

THE Philippines is lagging behind other members of the Association of Southeast Asian Nations (Asean) both in attracting banks into the country and in penetrating the banking market in the region.

The Philippine Institute for Development Studies (PIDS) said the Philippines has attracted fewer foreign banks as compared to its counterparts in the region.

The report on the country’s financial system titled "Enhancing Access to Financial Services through a More Competitive Financial System,” showed that the Philippines was able to attract only three banks, one each from Malaysia, Singapore and Thailand, as of end 2013.

Other Asean countries were able to attract more banks from AMS than the Philippines.

For instance, two banks each from Malaysia and Thailandand three banks from Singapore had established their presence in Vietnam.

The report, which was presented by former PIDS President Mario B. Lamberte and his research associate, Ammielou Q. Gaduena, is a component study of the Advancing Philippine Competitiveness (Complete) project funded by the United States Agency for International Development.

The authors have examined the actual penetration of domestic banks in other Asean countries.

Ten largest domestic banks, in terms of assets of each country, were considered, since these banks were in a better position to set up branches or subsidiaries in other countries.

For the Philippines, they identified Banco de Oro, Metrobank, Bank of the Philippine Islands, Land Bank of the Philippines, Philippine National Bank, Rizal Commercial Banking Corp., China Bank, Union Bank, Security Bank and United Coconut Planters Bank.

They also verified their presence in other Asean countries either in the form of a branch or a subsidiary.

Among the six AMSs, only the Philippine and Vietnamese banks did not have presence in other AMSs.

The report showed two Indonesian banks had each a branch in Singapore. Four Malaysian banks had a presence in other AMSs. Among them, Maybank appears to be the most aggressive in extending its presence in other AMSs.

Of the five domestic banks in Singapore, three banks had established their presence in other Asian countries.

Among them, only United Overseas Bank had branches and subsidiaries in the other five Asean countries. Three Thai banks had branches or subsidiaries in other countries in the region.

It noted that all the three global banks, namely, HSBC, Standard Chartered and Citibank, have presence in six Asean countries.

As to the banks’ sizes, in terms of total assets and deposits of banks in the six Asian countries, researchers have focused only on the first three largest banks of each country.

The three Singaporean banks stood out among the banks in the Asean in terms of total assets. A far second and third were the three banks in Malaysia and Thailand, respectively.

"Philippine banks were among the smallest banks in the region. The total assets of the third-largest bank in Malaysia and Thailand were roughly three times higher than those of the largest bank in the Philippines,” the report said.

"The assets of the largest bank in the Philippines were even smaller than those of the third-largest bank in Indonesia,” it added.

The PIDS said the Philippines has a lot of catching up to do to make its financial-services sector at least as developed as those of Malaysia’s and Thailand’s.

The Philippines has to enhance its capacity to contributeto the country’s development, which is even more compelling in light of Asean’s plan to establish an integrated financial system.//

PHL lags behind other Asean countries in attracting foreign banks—PIDS report