FINANCE Secretary-designate Benjamin E. Diokno vowed the government will be “opportunistic” on foreign borrowings as the peso hit its weakest level against the greenback in more than 16 years.

Diokno, who is the outgoing Bangko Sentral ng Pilipinas (BSP) governor, told reporters that the government will continue to rely on domestic borrowings to lessen the impact of currency fluctuations on the national government debt.

“We will be opportunistic. So if there’s a good opportunity to borrow in foreign currency, we will do that; but right now, our bias is to rely on domestic borrowing,” Diokno told reporters following a turnover ceremony at the Department of Finance last Wednesday, the day the peso crossed the P55-$1 territory.

But Diokno said the weakening of the peso should not be a concern, pointing out that the peso remains “competitive” compared to other currencies.

During the DOF turnover ceremony, Diokno vowed to keep the country’s debt-to-GDP ratio within the “sustainable threshold” while balancing the need to sustain the country’s economic recovery.

He also vowed that the Marcos administration will work towards achieving three goals by the end of the president’s term: reduce the deficit-to-GDP ratio to three percent; achieve upper-middle-income status; and, bring down poverty incidence to single-digits.

For his part, Duterte’s finance secretary Carlos G. Dominguez III said Diokno is the “best possible choice” to succeed him because the outgoing central bank governor possesses “the skills, the insight and the dedication” to take on the demanding job of Secretary of Finance.

Dominguez also said he hopes that their proposed fiscal consolidation will be “somewhat useful” for the new administration to help manage the country’s debt and sustain the country’s economic recovery.

The DOF recently unveiled its proposed fiscal consolidation and resource mobilization plan seen to generate a total average of nearly P350 billion per year from 2023 to 2027 to help the country outgrow its debt at a faster rate. The 3-package proposed fiscal consolidation and resource mobilization plan include the imposition of several taxes and the 3-year deferment of the second tranche of reduction in personal income tax rates. It also includes the expansion of the value-added tax (VAT) base and the removal of VAT exemptions—except for education, agricultural products, health, financial sector and raw food, among others.

As of end- April, the national government’s outstanding debt zoomed to another record-high at P12.76 trillion, just two months before President Duterte steps down from office.

The national government’s debt-to-gross domestic product (GDP) ratio as of the first quarter of the year rose to 63.5 percent, above the internationally recommended 60-percent threshold by multilateral lenders for emerging markets like the Philippines. It is also the highest since the country’s debt-to-GDP ratio hit 65.7 percent in 2005 under the Arroyo administration.

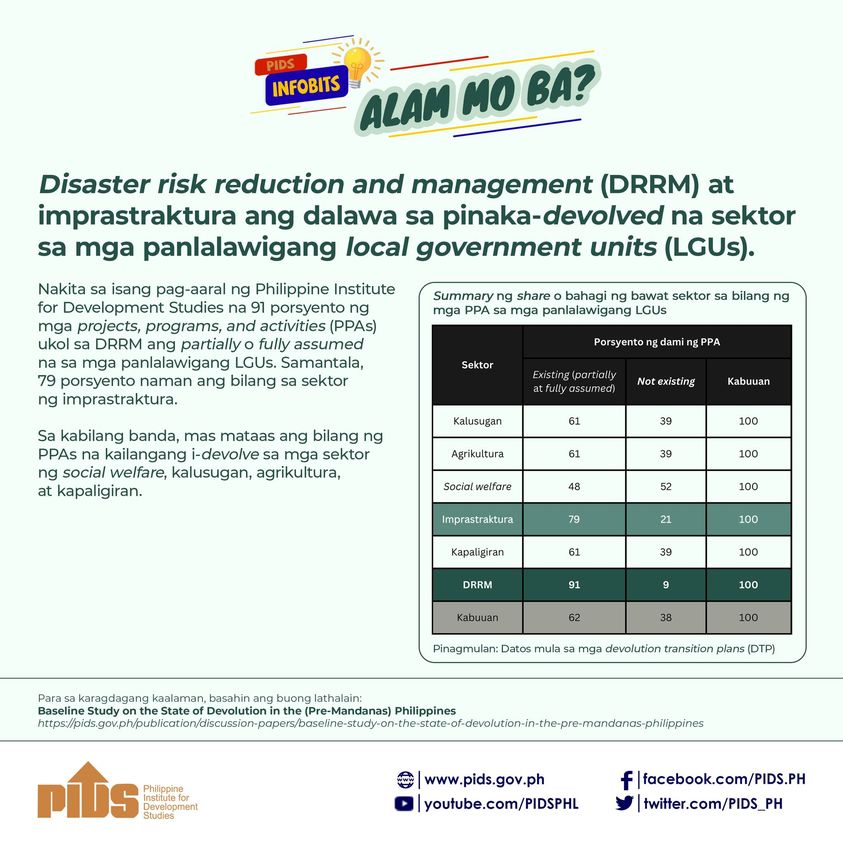

Last May, when the peso hovered at P52-$1, state think tank Philippine Institute for Development Studies (PIDS) said that the country’s debt-to-GDP ratio, which has climbed to 60.5 percent in 2021 from 39.6 percent in 2019, is still manageable.

However, returning to its pre-pandemic levels may not be feasible in the near term, the PIDS study said.