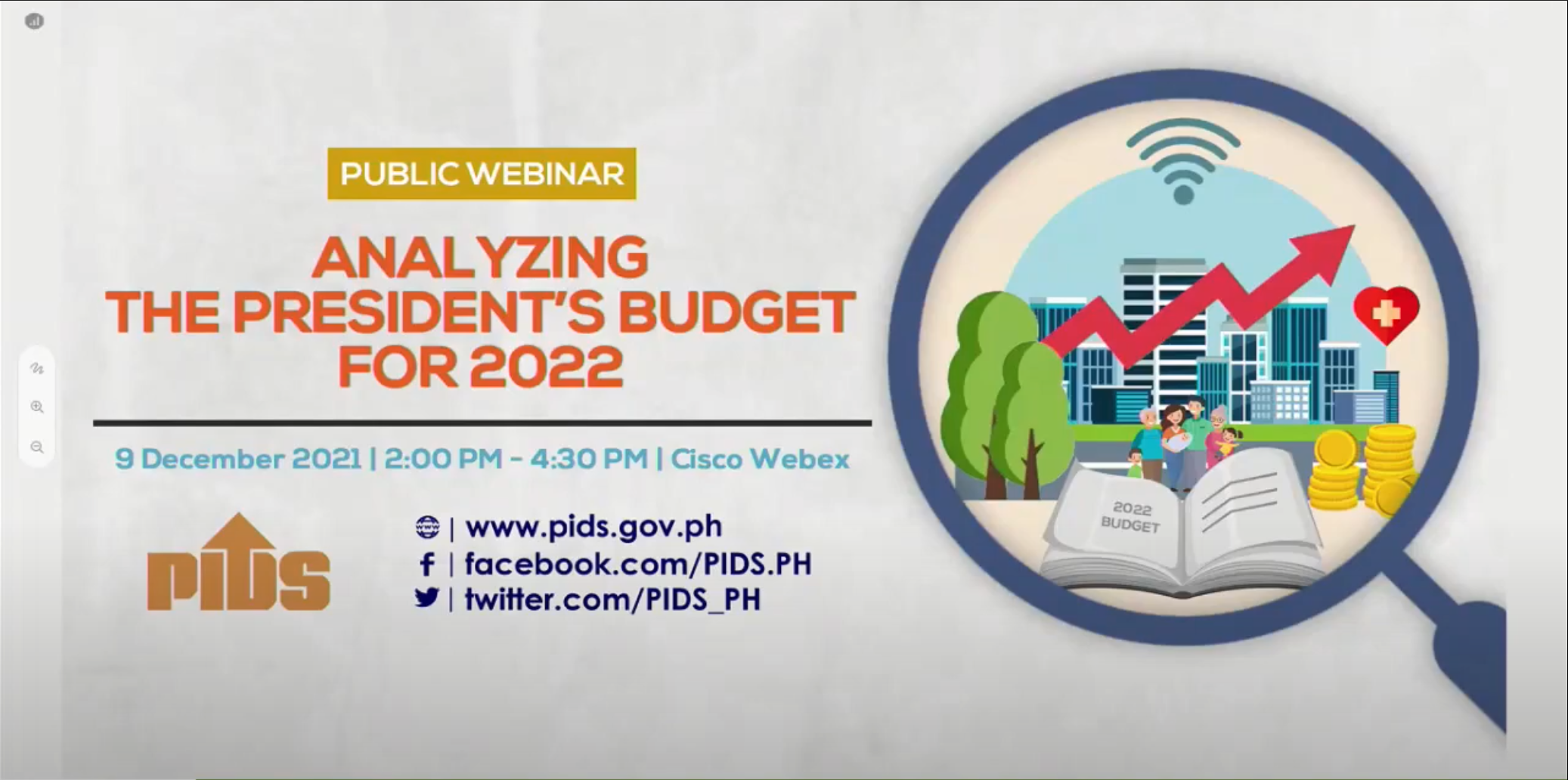

Local governments’ internal revenue allotment (IRA) will balloon to more than P1 trillion in 2022 as a result of the Supreme Court’s ruling that mandated sourcing them from “all” national taxes, putting pressure on the national government’s resources, the state-run Philippine Institute for Development Studies (PIDS) said.

In a webinar last week, former PIDS senior research fellow Rosario G. Manasan said estimates of the Cabinet-level Development Budget Coordination Committee last December showed that the so-called Mandanas-Garcia petitions would jack up local government units’ (LGUs) aggregate IRA to P1.1 trillion in 2022 from P847.4 billion under the current way of computing IRA.

At present, LGU’s IRA comes from 40 percent of national internal revenue taxes collected by the Bureau of Internal Revenue (BIR).

However, the Supreme Court ruling in 2018, which it reaffirmed last year, on the petitions of Batangas Gov. Hermilando Mandanas and former Bataan Gov. Enrique Garcia Jr. stated that the IRA must come from two-fifths of collections of “all” national taxes—including collections from import duties and other levies by the Bureau of Customs on top of the BIR tax take.

Economic managers had warned that implementation of this high court ruling could “create a fiscal problem” as it would result in an “unmanageable budget deficit.”

As such, the economic team had proposed to pass on additional costs to LGUs, including spending on agriculture, education, health-care and infrastructure such as roads.

Manasan said more recent estimates of the Department of Budget and Management showed aggregate 2022 IRA would amount to P1.08 trillion under the Supreme Court ruling instead of only P848.4 billion.

For the national government to offset the bigger IRA requirements, Manasan said it might “increase tax rate/s or impose new tax/es to generate additional government revenue equal to 0.9 percent of GDP (gross domestic product) in 2022.”

However, Manasan admitted that raising taxes “will not be easy; may not even be feasible” during this time.

Another suggestion by Manasan to maintain fiscal sustainability despite a larger IRA was increasing the fiscal deficit by 0.9 percent of GDP yearly.

“Increasing the fiscal deficit is likely to be fiscally sustainable in the short term given that the country’s national government debt-to-GDP ratio is lower than international benchmark. But implementing a more expansionary fiscal stance long term may be risky from a fiscal sustainability perspective,” Manasan said.

Another option that Manasan presented was for the national government to “unfund some programs, activities and projects that are now funded under the general appropriations act to create fiscal space for increase in IRA.” INQ

In a webinar last week, former PIDS senior research fellow Rosario G. Manasan said estimates of the Cabinet-level Development Budget Coordination Committee last December showed that the so-called Mandanas-Garcia petitions would jack up local government units’ (LGUs) aggregate IRA to P1.1 trillion in 2022 from P847.4 billion under the current way of computing IRA.

At present, LGU’s IRA comes from 40 percent of national internal revenue taxes collected by the Bureau of Internal Revenue (BIR).

However, the Supreme Court ruling in 2018, which it reaffirmed last year, on the petitions of Batangas Gov. Hermilando Mandanas and former Bataan Gov. Enrique Garcia Jr. stated that the IRA must come from two-fifths of collections of “all” national taxes—including collections from import duties and other levies by the Bureau of Customs on top of the BIR tax take.

Economic managers had warned that implementation of this high court ruling could “create a fiscal problem” as it would result in an “unmanageable budget deficit.”

As such, the economic team had proposed to pass on additional costs to LGUs, including spending on agriculture, education, health-care and infrastructure such as roads.

Manasan said more recent estimates of the Department of Budget and Management showed aggregate 2022 IRA would amount to P1.08 trillion under the Supreme Court ruling instead of only P848.4 billion.

For the national government to offset the bigger IRA requirements, Manasan said it might “increase tax rate/s or impose new tax/es to generate additional government revenue equal to 0.9 percent of GDP (gross domestic product) in 2022.”

However, Manasan admitted that raising taxes “will not be easy; may not even be feasible” during this time.

Another suggestion by Manasan to maintain fiscal sustainability despite a larger IRA was increasing the fiscal deficit by 0.9 percent of GDP yearly.

“Increasing the fiscal deficit is likely to be fiscally sustainable in the short term given that the country’s national government debt-to-GDP ratio is lower than international benchmark. But implementing a more expansionary fiscal stance long term may be risky from a fiscal sustainability perspective,” Manasan said.

Another option that Manasan presented was for the national government to “unfund some programs, activities and projects that are now funded under the general appropriations act to create fiscal space for increase in IRA.” INQ