Trade in Asia-Pacific will soon get a shot in the arm if the Regional Comprehensive Economic Partnership is signed next year. Members of the Association of Southeast Asian Nations (Asean) and six other major economies in the region are now finalizing a “mega-trade deal” that is expected to dispel the doom caused by the trade war between the United States and China. RCEP parties have good reason to bank on the trade arrangement as their economies accounted for nearly half of the world population, close to one-third of the global economy, nearly 30 percent of global trade and about one-third of global investment inflows last year.

The Philippines, one of the parties to the RCEP, is also keen on the immediate signing of the trade deal. So much so that President Duterte had even urged Indian Prime Minister Narendra Modi to conclude RCEP to narrow the development gap within the region (See, “Duterte prods Modi on RCEP conclusion,” in the BusinessMirror, November 4, 2019). The President made this remark ahead of the RCEP Summit in Thailand, where Asean leaders and their trade partners sought to conclude the negotiations for the trade deal.

Manila is excited about RCEP because it will allow the Philippines to gain access to the markets of rich Asia-Pacific countries—Japan, South Korea, New Zealand and Australia. Japan and South Korea, in particular, are major buyers of Philippine products, and for the longest time, Manila had been badgering these Asian countries to slash tariffs on agricultural goods to help improve the competitiveness of Filipino farmers. China, a prime mover of the RCEP, is also another big market where the Philippines could ship more agricultural products.

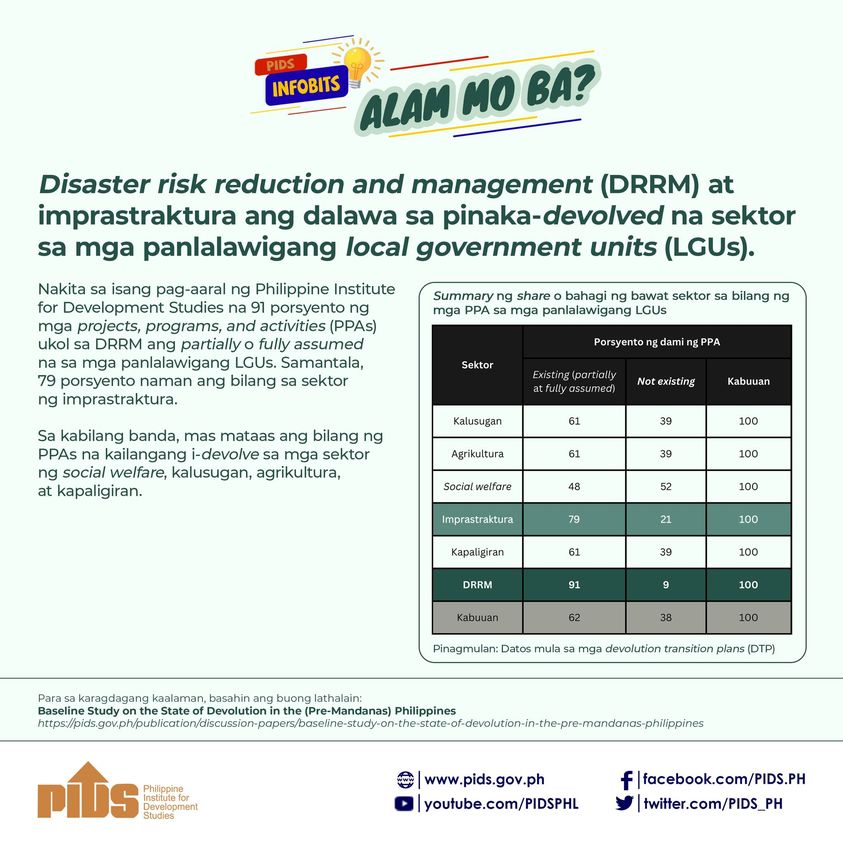

While the RCEP may present huge opportunities, the Philippines is not known to take full advantage of these trade arrangements. In fact, the Philippines is a laggard among the Asean-5 (the largest economies in Asean) in terms of export earnings, according to a report published by the World Trade Organization in 2017. Also, despite the huge reduction in tariffs under the Asean Free Trade Area, data from the Philippine Statistics Authority (PSA) showed that the economic bloc enjoyed a large surplus with the Philippines. In August alone, the total surplus of Asean countries with the Philippines is at $1.42 billion as the country’s imports from its neighbors outpaced its exports.

There are a number of reasons for the inability of the private sector, particularly the micro, small and medium enterprises, to tap the international market. A discussion paper published by the Philippine Institute for Development Studies last year indicated that aside from tariffs, MSMEs said their lack of access to finance and the high standards required by importing countries for products or services for export also served as obstacles to their participation in global value chains. These high standards would include tough sanitary and phytosanitary requirements that prevent local producers from shipping more goods to export markets.

The government must address these issues if it is really serious about helping local producers earn from trade deals, such as RCEP. The grant of market access is a two-way street, meaning rich Asia-Pacific countries will also have the opportunity to ship more products to us and compete with Philippine-made goods. Cutting tariffs via trade arrangements will not benefit the Philippines if local goods are not competitive against imports and businesses are unable to participate in international trade.