Credit gap, the difference between credit given and actual demand, for small and medium enterprises in the Association of South East Asian Nations is estimated at $52.8 billion.

The huge credit gap will likely widen if SMEs are not helped, according to experts in a forum sponsored by state think tank Philippine Institute for Development Studies (PIDS), Asian Development Bank (ADB), Department of Trade and Industry, Management Association of the Philippines, and Financial Executives of the Philippines.

The experts pointed out that a lot can still be done to unleash the potential of SMEs.

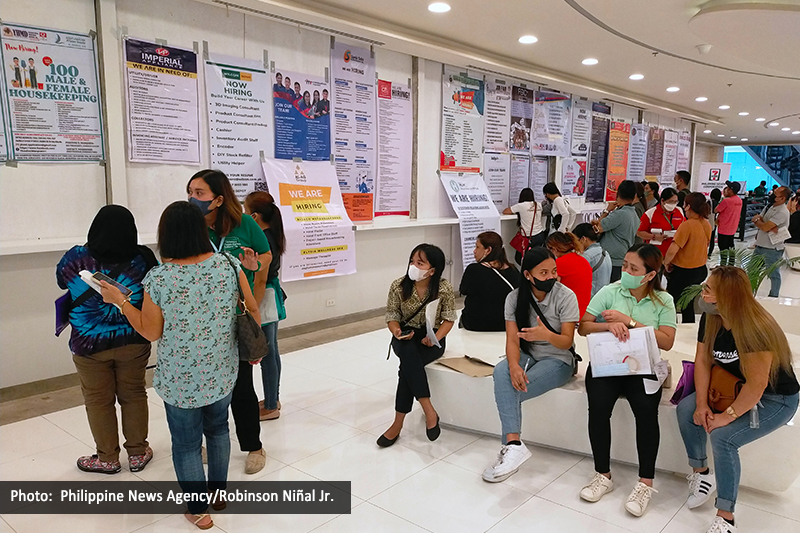

Despite the significant contribution of small and medium enterprises (SMEs) to employment and to the economies, experts said they remain as one of the region’s untapped resources.

SMEs comprise the largest number of firms in the Asean region, producing majority of jobs and substantially contributing to the sub-region’s gross domestic product (GDP).

BambangSusanto, ADB’s vice president for knowledge management and sustainable development, stressed in his keynote address the importance of opening access and opportunities for MSMEs.

To help SMEs play their role in the domestic, regional and global production networks, Susanto said the Asean Economic Community (AEC) must build the physical connectivity of SMEs, raise their labor productivity and skills to standards of global value chains, and improve their access to finance.

Meanwhile, Erlinda Medalla, PIDS senior research fellow, and GaneshanWignaraja, ADB advisor, discussed ways on how to improve SMEs’ access to market and investment opportunities in the AEC.

“SMEs play a role not just as a vehicle for poverty reduction but also as an engine of growth,” Medalla said.

She emphasized the sector’s employment and value added contributions to the Philippines, which peaked at 65 percent and 35 percent, respectively.

Across Southeast Asia, Wignaraja noted SME employment makes up 74 percent of all jobs, and contributes 41 percent of the GDP of Asean economies.

Yet, Wignaraja said these contributions are not yet reflected in international trade.

Wignaraja said high-performing SMEs make up only 21 percent of direct exports across Asean economies.

Many factors obstruct the growth of SMEs, but one of the often cited problems is the lack of access to finance and credit.

Wignaraja said the current banking and credit structure does not know how to deal with SMEs. Bank requirements on collateral and business and finance plans are strict.

Unable to comply and lacking financial literacy, SMEs are often forced to rely on informal resources, as they simply do not have access to the capital they need to expand or participate in larger business and trading activities.

Wignaraja said the total credit gap, or the difference between formal credit provided to SMEs and estimated SME financing needs in Asean, amounts to as much as $52.8 billion.

Wignaraja also pointed out as China begins to slow down and move out of labor-intensive industries, firms in countries like the Philippines, Malaysia and Thailand will have more business opportunities as suppliers of a range of products.

“International trade itself has fundamentally changed in the 21st century and is no longer about direct exports. Instead, trade increasingly means global supply chains where different production on stages are located across geographical space and linked by trade in intermediate inputs and final goods,” Wignaraja said.

Medalla said the Philippines does not have much of a choice whether or not it wants to partake in this new landscape.

In an increasingly economically integrated Asean, she said, “SMEs have to work within a globalized setting.”

However, she added “not all SMEs can export, and they do not need to. The goal should be for them to have all the opportunities to participate and engage in business in order to help them grow and contribute in sustaining the expansion of the economy.”

To do this, Medalla enumerated a number of factors that the Philippines has to address to encourage SMEs to participate in value chains.

She reiterated Wignaraja’s point about addressing the lack of access to finance and credit, but added that enabling the environment for SMEs to develop competitiveness and connectivity must be prioritized as well.

While Wignaraja believes much of the work must be done by business and private sector in boosting labor productivity, improving the investment climate, raising infrastructure spending, improving information and communication technology infrastructure, and increasing financial access for SMEs, both experts agree that the government also has a critical role to play in SMEs’ success.

“Government’s role is to enable and facilitate the linkages and access to markets, finance and technology, and to remove various barriers to entry and exit. The role of the new Competition Law will be very important,” Medalla said.

Policymakers should also concentrate on enhancing strategic opportunities. Medalla said the kind of policies needed depends on which SME sector policymakers intend to help.

She recommended policies that would raise SMEs’ capability to comply with AEC standards, such as developing the halal industry, improving trade facilitation and identifying standards to enable them to access a “duty-free” Asean market.

She also recommended helping each sector gain competitive advantage through industry clustering, sharing services facilities and developing industry roadmaps.

“The opportunities are there in the supply chains,” Wignaraja said.//

The huge credit gap will likely widen if SMEs are not helped, according to experts in a forum sponsored by state think tank Philippine Institute for Development Studies (PIDS), Asian Development Bank (ADB), Department of Trade and Industry, Management Association of the Philippines, and Financial Executives of the Philippines.

The experts pointed out that a lot can still be done to unleash the potential of SMEs.

Despite the significant contribution of small and medium enterprises (SMEs) to employment and to the economies, experts said they remain as one of the region’s untapped resources.

SMEs comprise the largest number of firms in the Asean region, producing majority of jobs and substantially contributing to the sub-region’s gross domestic product (GDP).

BambangSusanto, ADB’s vice president for knowledge management and sustainable development, stressed in his keynote address the importance of opening access and opportunities for MSMEs.

To help SMEs play their role in the domestic, regional and global production networks, Susanto said the Asean Economic Community (AEC) must build the physical connectivity of SMEs, raise their labor productivity and skills to standards of global value chains, and improve their access to finance.

Meanwhile, Erlinda Medalla, PIDS senior research fellow, and GaneshanWignaraja, ADB advisor, discussed ways on how to improve SMEs’ access to market and investment opportunities in the AEC.

“SMEs play a role not just as a vehicle for poverty reduction but also as an engine of growth,” Medalla said.

She emphasized the sector’s employment and value added contributions to the Philippines, which peaked at 65 percent and 35 percent, respectively.

Across Southeast Asia, Wignaraja noted SME employment makes up 74 percent of all jobs, and contributes 41 percent of the GDP of Asean economies.

Yet, Wignaraja said these contributions are not yet reflected in international trade.

Wignaraja said high-performing SMEs make up only 21 percent of direct exports across Asean economies.

Many factors obstruct the growth of SMEs, but one of the often cited problems is the lack of access to finance and credit.

Wignaraja said the current banking and credit structure does not know how to deal with SMEs. Bank requirements on collateral and business and finance plans are strict.

Unable to comply and lacking financial literacy, SMEs are often forced to rely on informal resources, as they simply do not have access to the capital they need to expand or participate in larger business and trading activities.

Wignaraja said the total credit gap, or the difference between formal credit provided to SMEs and estimated SME financing needs in Asean, amounts to as much as $52.8 billion.

Wignaraja also pointed out as China begins to slow down and move out of labor-intensive industries, firms in countries like the Philippines, Malaysia and Thailand will have more business opportunities as suppliers of a range of products.

“International trade itself has fundamentally changed in the 21st century and is no longer about direct exports. Instead, trade increasingly means global supply chains where different production on stages are located across geographical space and linked by trade in intermediate inputs and final goods,” Wignaraja said.

Medalla said the Philippines does not have much of a choice whether or not it wants to partake in this new landscape.

In an increasingly economically integrated Asean, she said, “SMEs have to work within a globalized setting.”

However, she added “not all SMEs can export, and they do not need to. The goal should be for them to have all the opportunities to participate and engage in business in order to help them grow and contribute in sustaining the expansion of the economy.”

To do this, Medalla enumerated a number of factors that the Philippines has to address to encourage SMEs to participate in value chains.

She reiterated Wignaraja’s point about addressing the lack of access to finance and credit, but added that enabling the environment for SMEs to develop competitiveness and connectivity must be prioritized as well.

While Wignaraja believes much of the work must be done by business and private sector in boosting labor productivity, improving the investment climate, raising infrastructure spending, improving information and communication technology infrastructure, and increasing financial access for SMEs, both experts agree that the government also has a critical role to play in SMEs’ success.

“Government’s role is to enable and facilitate the linkages and access to markets, finance and technology, and to remove various barriers to entry and exit. The role of the new Competition Law will be very important,” Medalla said.

Policymakers should also concentrate on enhancing strategic opportunities. Medalla said the kind of policies needed depends on which SME sector policymakers intend to help.

She recommended policies that would raise SMEs’ capability to comply with AEC standards, such as developing the halal industry, improving trade facilitation and identifying standards to enable them to access a “duty-free” Asean market.

She also recommended helping each sector gain competitive advantage through industry clustering, sharing services facilities and developing industry roadmaps.

“The opportunities are there in the supply chains,” Wignaraja said.//