Tension between Manila and Beijing was heating up due to the South China Sea dispute. But with the entry of the new administration, the two countries’ relations are apparently turning for the better, with the Philippines’s agriculture secretary now seeing the improving economic ties between the Philippines and China as a major catalyst for agriculture growth.

Backed by President Duterte’s wishes to improve ties with China, Agriculture Secretary Emmanuel F. Pinol seeks a bigger share in the Chinese market for local farm produce.

Since assuming office, Mr. Duterte has been vocal about being more open to China than other allied nations, stressing that he could shrug off economic ties with the United States and just prioritize trade relations with China.

On the other hand, the country’s agriculture secretary has been keen on opening more markets for Philippine agricultural products to as near as South Korea and as far as the Russian Federation and Argentina. And Piñol thinks it’s time to develop a wider market in China.

As data shows, China is one of the country’s top market for agriculture-based and related exports. China accounted for 8.7 percent of the country’s total agricultural exports for the past six years. From 2010 to 2016, the Philippines exported a total volume of 5.375 million metric tons (MMT) valued at $2.97 billion.

On a year-on-year basis, how-ever, agriculture exports to China plunged 36.93 percent in 2015, the highest and only decline in exports receipts since 2010. Does it have to do with the West Philippine Sea (WPS) dispute? Economist Roehlano Briones of the Philippine Institute for Development Studies said it doesn’t.

“We have to remember that China’s economic growth has slowed down during that time. It’s really about their economic slowdown and nothing to do with the arbitration,” Briones said. In 2015 the Philippines filed an arbitration case against China before the United Nations over the disputed territories in the WPS.

The Philippines’s agriculture-based exports to China in 2015 reached 679,319 MT amounting to $460 million. Before 2015, agricultural exports to China continued posting growth during the six-year time frame. Export receipts to China peaked in 2014 in the past six years, when the Philippines exported a whopping 1.442 MMT at valued to $729 million.

To date, the Philippines’s agricultural exports to China seemed to be slowly recovering, reaching $222.953 million for the first half of 2016, nearly half the total exports to the Chinese market last year.

For the past years, vegetables and fruits topped the agricultural exports to China. In 2015 shipments of vegetables and fruits to China accounted for 85 percent of the China’s total agricultural imports from the Philippines. Vegetables and fruits export receipts amounted to $267 million.

The top agricultural export to China was banana, reaching $157.499 million in 2015. China accounts for 24 percent of the total Philippine banana exports annually.

The Philippines also exports the following commodity groups to China: fish and fish preparations; animal and vegetable oils and fats; cereals and cereals preparations; crude rubber, sugar, tobacco and live animals, among others.

Local experts note that if Mr. Duterte is keen on strengthening economic ties with China, he should pursue a bilateral trade agreement with Beijing, as his mere warm remarks toward the Chinese will not directly result in better numbers.

“As it is, we have a generally good economic relationship with China, except for a few trade disputes here and there. But I don’t believe there’s a bleeding from political relationship to economic ties, or vice versa,” Briones said.

Briones noted that a warming of economic ties between the Philippines and China could only happen if Mr. Duterte, during his slated state visit in China later this month, opens bilateral trade talks with his counterpart Xi Jinping.

Nonetheless, Briones said the Philippines should continue capitalizing on the favorable importation measures by China on agricultural goods.

“We must be more competitive. We must sell them better bananas and other products. We must bank on the fact China is less stringent in terms of importation measures than Japan and Korea,” he said.

For Pablito M. Villegas, president and CEO of Meganomics Specialists Inc., an agricultural think tank, if

the Philippines wants a bigger grab of the Chinese market, then it should secure a steady flow of supply to meet the consistent and even growing demand from China. Villegas suggests that the Philippines consider developing the agriculture sector and improving the value chain through an “agro-industrial processing-based” approach.

In an agro-industrial processing-based approach, the country is clustered according to production areas and strategic points, such as airports and ports. More so, in such approach, raw produce is geared toward a specific processed product, making it more competitive compared to just being a fresh produce, Villegas said.

“We really have to change our strategy. Big companies must be encouraged to go to agribusiness. It’s not anymore about having fresh produce, it should be agro-based industrial approach to develop our agriculture,” said Villegas, who served as a senior agricultural economist for the Food and Agricultural Organization.

“We just have to identify our comparative advantages. For example, where can we grow this crop near a port so that we can ship it right after harvest?” he added.

During the annual China-Asean Expo in Nanning, China, the Philippines pitched to Chinese investors and busi-nessmen investment proposals to the country’s agriculture sector, particularly in the rural areas, such as the development of projects geared toward agribusiness and agritourism.

In turn, Chinese businessmen also expressed their interest in investing in the Philippines, especially if relations between Manila and Beijing will improve under the Duterte administration.

Recently, Agriculture Undersecretary for Administration and Finance Bernadette Romulo-Puyat proposes the renewal of the five-year development plan to Chinese Ambassador Zhao Jianhua during a courtesy meeting late last month.

The undersecretary said continuing the five-year development plan would greatly strengthen ties with China, particularly in agriculture. Exploring another five-year development with China may be an option to save the ailing agriculture sector of the Philippines.

In end-August 2011 then-Philippine President Benigno S. Aquino III and then-Chinese President Hu Jintao inked the “Philippines-China Five-Year Development Program for Trade and Economic Cooperation,” a comprehensive blueprint where the two countries would exert trade efforts in identified sectors for mutual development.

The five-year development program focused on various sectors, including agriculture and fishery, mining, energy and forestry. The five-year plan was expected to generate at least $60 billion in revenues.

The Philippines’s new government also plans to court Chinese investment to fund an ambitious infrastructure program, the latest sign of warming ties between the two nations that have been at loggerheads over territorial claims in the South China Sea.

“The last administration hardly spoke to them,” Finance Secretary Carlos G. Dominguez III said in an interview in the World Bank’s headquarters in Washington, D.C., on Friday. “Now we are going to talk to them.”

“It’s time for us to lower the tensions,” he said. “You know the Chinese, they don’t like to lose face. Just as long as they don’t lose face, it’s OK to continue arguing with them.”

Since sweeping to victory in May elections, Philippine President Duterte has raised eyebrows with repeated attacks on traditional ally, the United States, and by calling for greater cooperation with China. Southeast Asian nations had, in the past, pushed for a united front against China, which prefers that disputes be settled through one-on-one talks.

In July an international tribunal ruled that China’s claims were unlawful in a case brought by the Philippines—a decision Beijing refused to recognize.

Chinese power

China has been expanding its regional clout through investing in infrastructure projects and plans to revive an ancient trading route stretching from Asia to Europe dubbed “One Belt, One Road.”

ldquo;We would like to direct them toward the infrastructure program that we are embarking upon, and you know we welcome them,” Dominguez said. He’s eyeing investment from the China-backed Asian Infrastructure Investment Bank, and the government will submit to the Philippine Senate its application to join the bank over coming days.

“That’s going to be a big source of funding for infrastructure spending.”

On the wider economy, the finance official played down investor concerns. The peso is trading near a seven-year low, while stocks had the biggest outflow in a year in September, prompted in part by President Duterte’s expletive-laden outbursts.

Among targets, President Barack Obama, who Mr. Duterte warned “you can go to hell” and that he may eventually “break up with America.” He has also told off both the European Union and the United Nations for their criticisms of his violent antidrug campaign that’s left more than 3,000 people dead.

Dominguez has said economic policies have been clear and consistent. S&P Global Ratings in September warned of “rising uncertainties surrounding the stability, predictability and accountability” under the new government.

GDP increased 7 percent in the second quarter from a year earlier, data in August showed, close on the heels of India’s 7.1-percent growth. The $292-billion economy is forecast to expand 6.4 percent this year, the quickest pace in Southeast Asia, according to economists surveyed by Bloomberg.

In the same interview, Bangko Sentral ng Pilipinas Governor Amando M. Tetangco Jr. also hosed down any concerns and said he sees little need to change monetary policy in the near term.

As Mr. Duterte is expected to be accompanied by a business delegation in his state visit to China from October 19 to 21, would the Philippine agriculture sector hear some good news afterward?

Backed by President Duterte’s wishes to improve ties with China, Agriculture Secretary Emmanuel F. Pinol seeks a bigger share in the Chinese market for local farm produce.

Since assuming office, Mr. Duterte has been vocal about being more open to China than other allied nations, stressing that he could shrug off economic ties with the United States and just prioritize trade relations with China.

On the other hand, the country’s agriculture secretary has been keen on opening more markets for Philippine agricultural products to as near as South Korea and as far as the Russian Federation and Argentina. And Piñol thinks it’s time to develop a wider market in China.

As data shows, China is one of the country’s top market for agriculture-based and related exports. China accounted for 8.7 percent of the country’s total agricultural exports for the past six years. From 2010 to 2016, the Philippines exported a total volume of 5.375 million metric tons (MMT) valued at $2.97 billion.

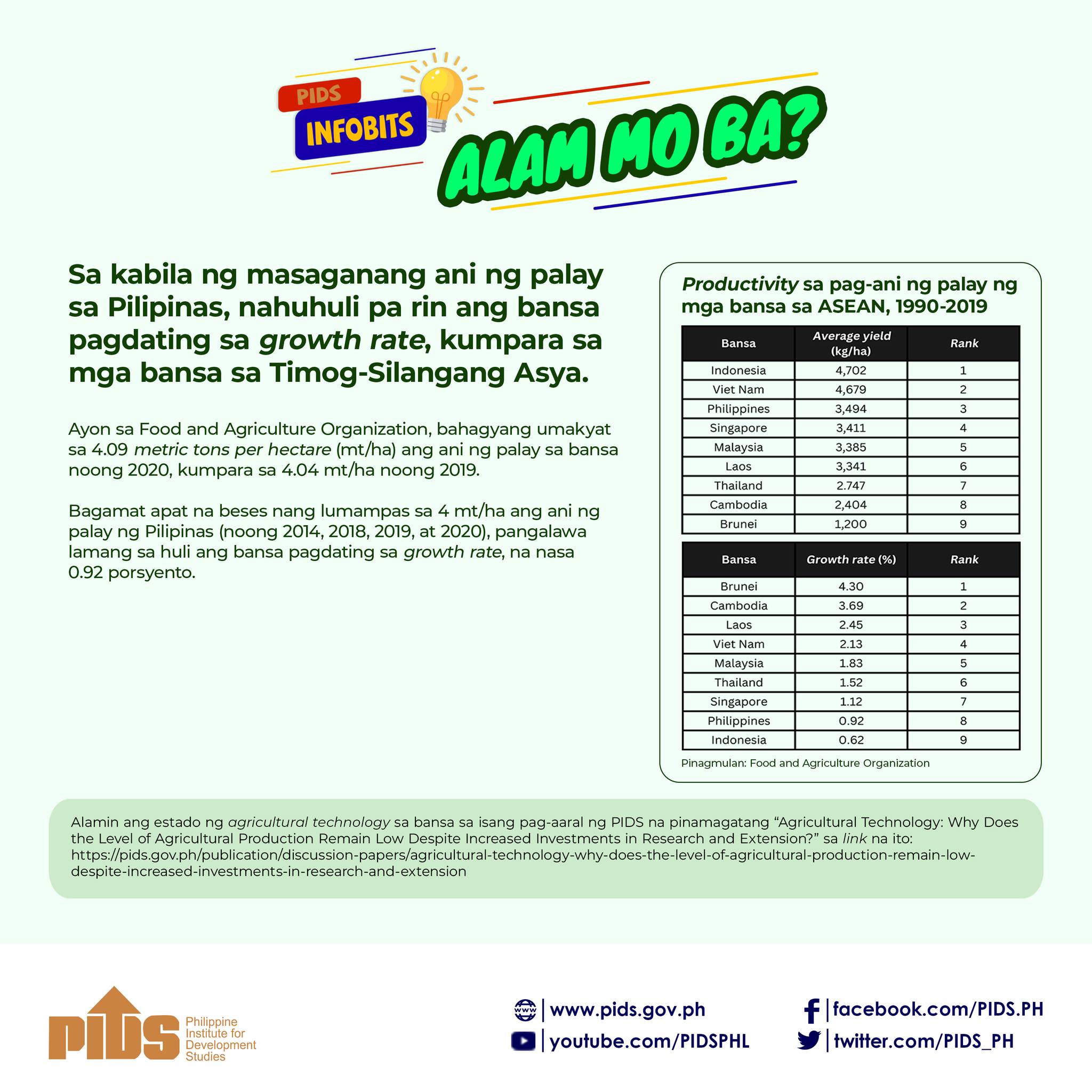

On a year-on-year basis, how-ever, agriculture exports to China plunged 36.93 percent in 2015, the highest and only decline in exports receipts since 2010. Does it have to do with the West Philippine Sea (WPS) dispute? Economist Roehlano Briones of the Philippine Institute for Development Studies said it doesn’t.

“We have to remember that China’s economic growth has slowed down during that time. It’s really about their economic slowdown and nothing to do with the arbitration,” Briones said. In 2015 the Philippines filed an arbitration case against China before the United Nations over the disputed territories in the WPS.

The Philippines’s agriculture-based exports to China in 2015 reached 679,319 MT amounting to $460 million. Before 2015, agricultural exports to China continued posting growth during the six-year time frame. Export receipts to China peaked in 2014 in the past six years, when the Philippines exported a whopping 1.442 MMT at valued to $729 million.

To date, the Philippines’s agricultural exports to China seemed to be slowly recovering, reaching $222.953 million for the first half of 2016, nearly half the total exports to the Chinese market last year.

For the past years, vegetables and fruits topped the agricultural exports to China. In 2015 shipments of vegetables and fruits to China accounted for 85 percent of the China’s total agricultural imports from the Philippines. Vegetables and fruits export receipts amounted to $267 million.

The top agricultural export to China was banana, reaching $157.499 million in 2015. China accounts for 24 percent of the total Philippine banana exports annually.

The Philippines also exports the following commodity groups to China: fish and fish preparations; animal and vegetable oils and fats; cereals and cereals preparations; crude rubber, sugar, tobacco and live animals, among others.

Local experts note that if Mr. Duterte is keen on strengthening economic ties with China, he should pursue a bilateral trade agreement with Beijing, as his mere warm remarks toward the Chinese will not directly result in better numbers.

“As it is, we have a generally good economic relationship with China, except for a few trade disputes here and there. But I don’t believe there’s a bleeding from political relationship to economic ties, or vice versa,” Briones said.

Briones noted that a warming of economic ties between the Philippines and China could only happen if Mr. Duterte, during his slated state visit in China later this month, opens bilateral trade talks with his counterpart Xi Jinping.

Nonetheless, Briones said the Philippines should continue capitalizing on the favorable importation measures by China on agricultural goods.

“We must be more competitive. We must sell them better bananas and other products. We must bank on the fact China is less stringent in terms of importation measures than Japan and Korea,” he said.

For Pablito M. Villegas, president and CEO of Meganomics Specialists Inc., an agricultural think tank, if

the Philippines wants a bigger grab of the Chinese market, then it should secure a steady flow of supply to meet the consistent and even growing demand from China. Villegas suggests that the Philippines consider developing the agriculture sector and improving the value chain through an “agro-industrial processing-based” approach.

In an agro-industrial processing-based approach, the country is clustered according to production areas and strategic points, such as airports and ports. More so, in such approach, raw produce is geared toward a specific processed product, making it more competitive compared to just being a fresh produce, Villegas said.

“We really have to change our strategy. Big companies must be encouraged to go to agribusiness. It’s not anymore about having fresh produce, it should be agro-based industrial approach to develop our agriculture,” said Villegas, who served as a senior agricultural economist for the Food and Agricultural Organization.

“We just have to identify our comparative advantages. For example, where can we grow this crop near a port so that we can ship it right after harvest?” he added.

During the annual China-Asean Expo in Nanning, China, the Philippines pitched to Chinese investors and busi-nessmen investment proposals to the country’s agriculture sector, particularly in the rural areas, such as the development of projects geared toward agribusiness and agritourism.

In turn, Chinese businessmen also expressed their interest in investing in the Philippines, especially if relations between Manila and Beijing will improve under the Duterte administration.

Recently, Agriculture Undersecretary for Administration and Finance Bernadette Romulo-Puyat proposes the renewal of the five-year development plan to Chinese Ambassador Zhao Jianhua during a courtesy meeting late last month.

The undersecretary said continuing the five-year development plan would greatly strengthen ties with China, particularly in agriculture. Exploring another five-year development with China may be an option to save the ailing agriculture sector of the Philippines.

In end-August 2011 then-Philippine President Benigno S. Aquino III and then-Chinese President Hu Jintao inked the “Philippines-China Five-Year Development Program for Trade and Economic Cooperation,” a comprehensive blueprint where the two countries would exert trade efforts in identified sectors for mutual development.

The five-year development program focused on various sectors, including agriculture and fishery, mining, energy and forestry. The five-year plan was expected to generate at least $60 billion in revenues.

The Philippines’s new government also plans to court Chinese investment to fund an ambitious infrastructure program, the latest sign of warming ties between the two nations that have been at loggerheads over territorial claims in the South China Sea.

“The last administration hardly spoke to them,” Finance Secretary Carlos G. Dominguez III said in an interview in the World Bank’s headquarters in Washington, D.C., on Friday. “Now we are going to talk to them.”

“It’s time for us to lower the tensions,” he said. “You know the Chinese, they don’t like to lose face. Just as long as they don’t lose face, it’s OK to continue arguing with them.”

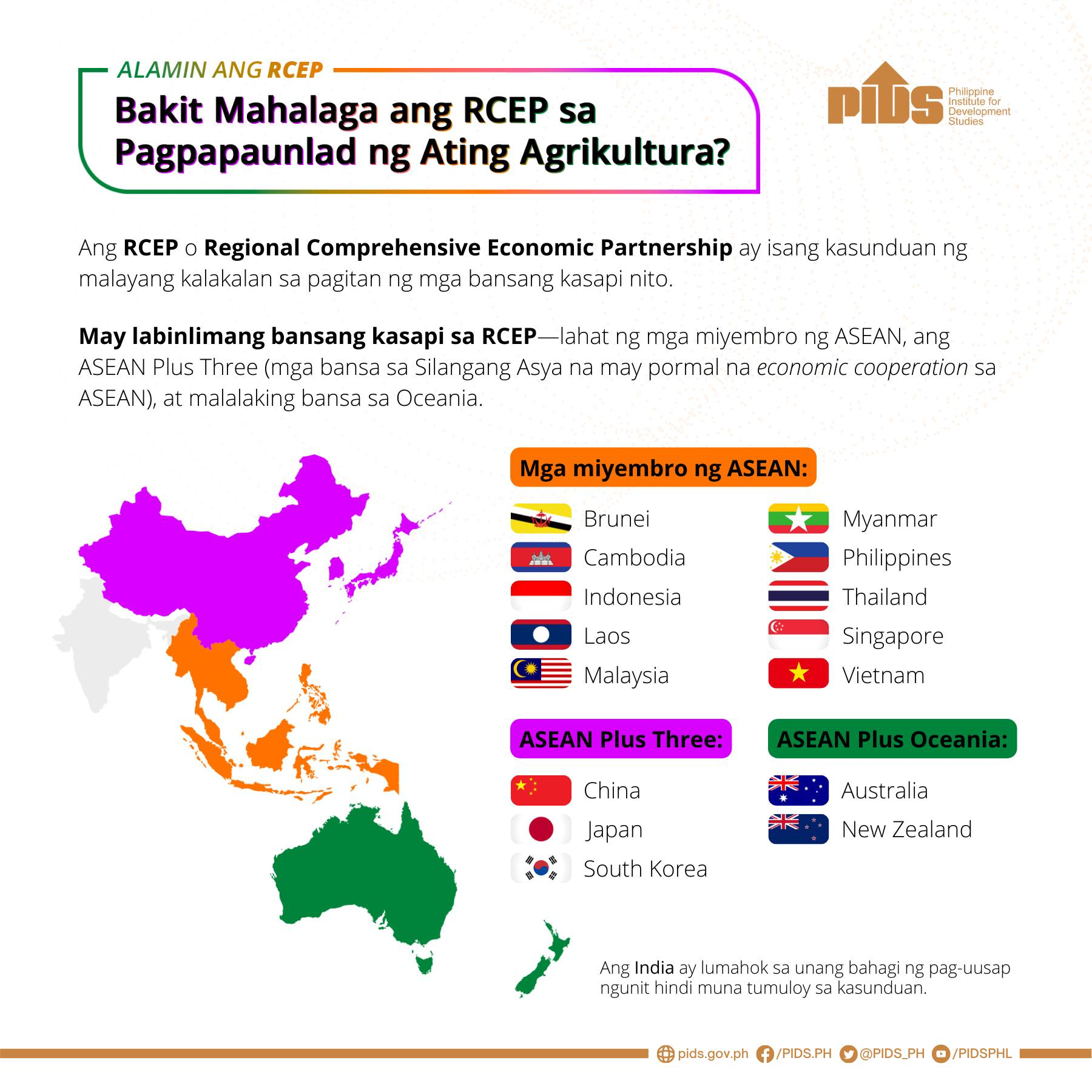

Since sweeping to victory in May elections, Philippine President Duterte has raised eyebrows with repeated attacks on traditional ally, the United States, and by calling for greater cooperation with China. Southeast Asian nations had, in the past, pushed for a united front against China, which prefers that disputes be settled through one-on-one talks.

In July an international tribunal ruled that China’s claims were unlawful in a case brought by the Philippines—a decision Beijing refused to recognize.

Chinese power

China has been expanding its regional clout through investing in infrastructure projects and plans to revive an ancient trading route stretching from Asia to Europe dubbed “One Belt, One Road.”

ldquo;We would like to direct them toward the infrastructure program that we are embarking upon, and you know we welcome them,” Dominguez said. He’s eyeing investment from the China-backed Asian Infrastructure Investment Bank, and the government will submit to the Philippine Senate its application to join the bank over coming days.

“That’s going to be a big source of funding for infrastructure spending.”

On the wider economy, the finance official played down investor concerns. The peso is trading near a seven-year low, while stocks had the biggest outflow in a year in September, prompted in part by President Duterte’s expletive-laden outbursts.

Among targets, President Barack Obama, who Mr. Duterte warned “you can go to hell” and that he may eventually “break up with America.” He has also told off both the European Union and the United Nations for their criticisms of his violent antidrug campaign that’s left more than 3,000 people dead.

Dominguez has said economic policies have been clear and consistent. S&P Global Ratings in September warned of “rising uncertainties surrounding the stability, predictability and accountability” under the new government.

GDP increased 7 percent in the second quarter from a year earlier, data in August showed, close on the heels of India’s 7.1-percent growth. The $292-billion economy is forecast to expand 6.4 percent this year, the quickest pace in Southeast Asia, according to economists surveyed by Bloomberg.

In the same interview, Bangko Sentral ng Pilipinas Governor Amando M. Tetangco Jr. also hosed down any concerns and said he sees little need to change monetary policy in the near term.

As Mr. Duterte is expected to be accompanied by a business delegation in his state visit to China from October 19 to 21, would the Philippine agriculture sector hear some good news afterward?