The national government should continue investing on human capital and infrastructure in order to attain fiscal consolidation that would eventually outgrow national debt while reducing inequality for inclusive growth, an economist suggested amid the economic problems brought by the Covid-19 pandemic.

In her paper entitled “Promoting an Investment-Driven Economy Through Good Governance”, economist Charlotte Justine Diokno-Sicat, said emphasized that investment both on human capital and infrastructure would encourage private sector participation at all levels.

And when these happen, Diokno-Sicat said they would put the Philippine’s fiscal house in order that would result in more business investments that include those in the tourism sector.

“There is a need for prudent and strategic spending to pump prime the economy to outgrow debt, given that the public debt ratio has increased from 39.6% in 2019 to 60.5% in 2021. Only an improved and innovative public sector will bridge the gap and reduce inequality for inclusive growth, and this should take the form of fiscal consolidation and strategic investments in physical and human capital,” said Diokno-Sicat.

The Philippine’s economic activity was severely affected with the pandemic due to lockdowns and policies that limited the mobility of the people for two years. This was further aggravated by the need to borrow money to sustain economic activity and purchase Covid-19 vaccines. Based on the latest report, the Philippine’s outstanding debt is now at P12 trillion.

How the country would effectively address the revival of the economy was covered by Diokno-Sicat’s paper which was launched during a virtual town hall discussion held March 31 and organized by think-tank Stratbase ADR Institute.

Diokno-Sicat is a research fellow for the Philippine Institute for Development Studies (PIDS) and vice president of the Philippine Economic Society (PES).

In her paper, she said there should be no policy reversals nor any major institutional disruptions that would affect revenue raising or spending capacity of the national government.

“The largest fiscal multipliers are in infrastructure which, in the short-term, increases income but long-term encourages more business investments and tourism. The 2022 allocation for infrastructure and capital outlays is 5.7 percent of GDP, far from the 6.7 percent in 2017 but higher than 2021. These prioritizations should be continued to jumpstart the economy.”

“There is a need for institutional innovations which cut across the public sector such as investments in data and information systems and harnessing digitalization,” she said.

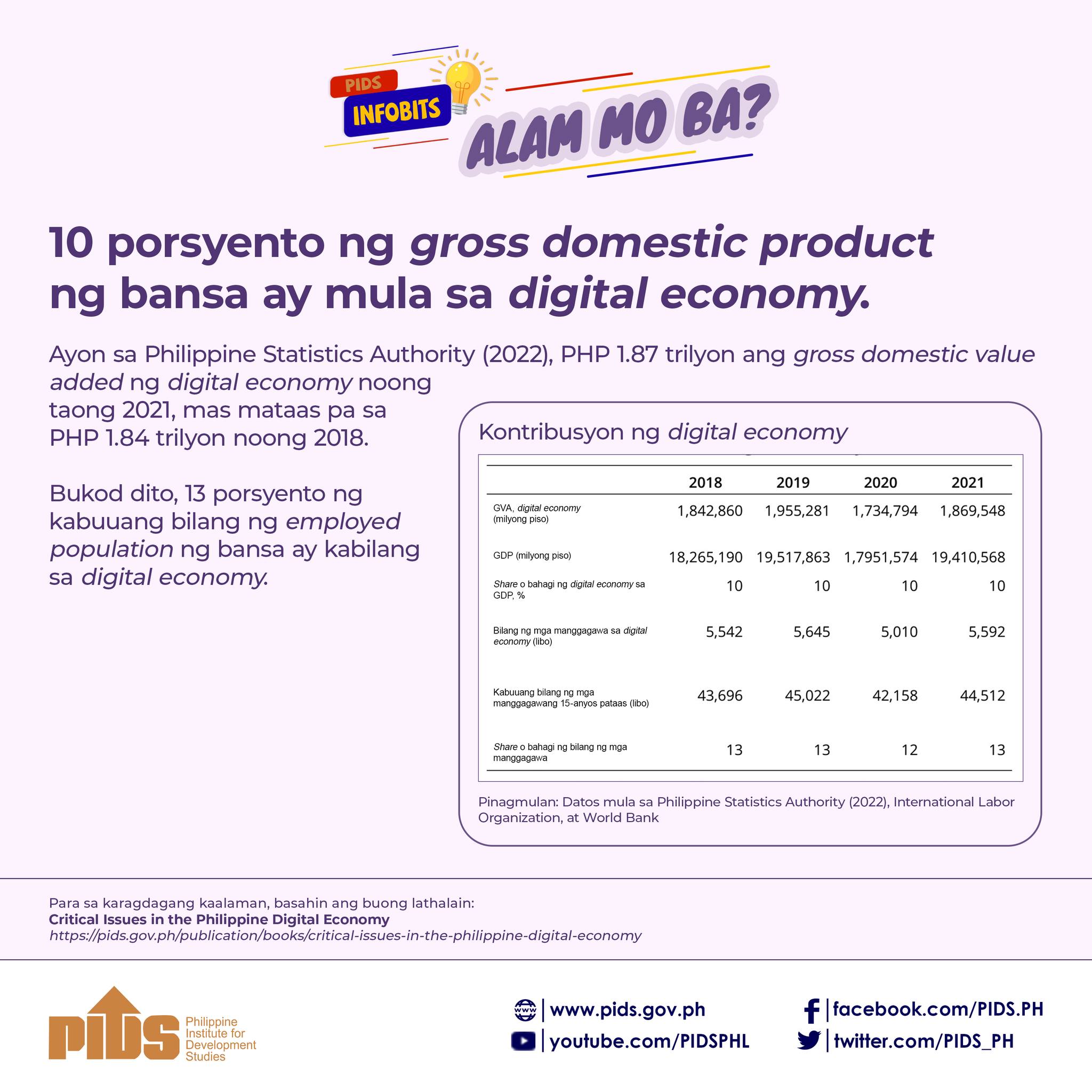

Diokno-Sicat also pointed out that the lack of capabilities and access to ICT (Information and Communication Technology) instruments cause a digital divide.

Digital divide is a gap between socio-demographics with access to ICT.

“E-government solutions will lead to social exclusion if these issues remain unaddressed. Harnessing digitalization requires a whole-of-society approach and provides a major role for the private sector contribute to/participate in to sustain economic recovery. This requires laying the foundation in infrastructure and systems, investments in human capital, financial sector, and private sector as partners,” the paper read.

“LGUs should contribute to economic recovery by strategically utilizing the adjustment in their intergovernmental fiscal transfers owing to the Mandanas ruling by: Strengthened development planning and investment programming; Enhancing local revenue mobilization; Looking for alternative arrangements (inter-local or with the private sector) for providing devolved goods and services,” it added.

For his part, Prof. Victor Andres “Dindo” Manhit, President, Stratbase ADR Institute said a multi-stakeholder strategy is needed to address inequality.

“We need public-private partnerships, investments by the private sector, and a better environment for investment by the incoming administration by June 30, 2022, with the hope that it can provide jobs, livelihood and income, and a comfortable life for many Filipinos in the long run,” said Manhit.

“The government can only create that environment, but it is the private sector that can create jobs,” he added.

These endeavors, according to Manhit, trigger a domino effect by creating jobs, providing income security, and spurring consumption and real growth. Indeed, at this point in time, sustainable strategies must be pursued, where the future generations can reap the long-term benefits.

But there is a catch, according to him: “To attract more investments to the country, the next government must uphold the rule of law, promote good governance, strengthen efforts in transparency and accountability, and spearhead political and economic reforms.”

“When prospective foreign investors see that even domestic players show positive response to government initiatives, then they too will join in the pursuit for honest and collective growth,” he stressed.

Other speakers in the virtual discussion were Dr. Ronald Mendoza, Dean of the Ateneo School of Government, Dr. Carlos Primo David, Trustee & Program Convenor, Stratbase ADR Institute and Convenor, Philippine Business for Environmental Stewardship (PBEST), Mr. Christopher Tan, Chief Operating Officer, PHINMA Education and Board Member, Philippine Association of Colleges and Universities, and Mr. Francisco del Rosario Jr., chairman of the Institute for Solidarity in Asia.