MANILA, Philippines – Small and medium enterprises in ASEAN must be given improved access to financing and global value chain to become significant contributors to the growth of the economic bloc, said state-run think tank Philippine Institute for Development Studies (PIDS).

In a recent forum organized by PIDS, experts from the Asian Development Bank (ADB), Department of Trade and Industry, Management Association of the Philippines and Financial Executives of the Philippines said despite the increasing contribution of SMEs to job creation in the region, their full potential has yet to be harnessed.

ADBs vice president for knowledge management and sustainable development Bambang Susanto said it is important to open access to finance and opportunities in the global value chain.

The ASEAN Economic Community (AEC) must build the physical connectivity of SMEs, raise their labor productivity and skills to standards of global value chains, and improve their access to finance, he said.

PIDS senior research fellow Erlinda Medalla said SMEs in the region must not only become a “vehicle for poverty reduction” but an engine of growth as well.

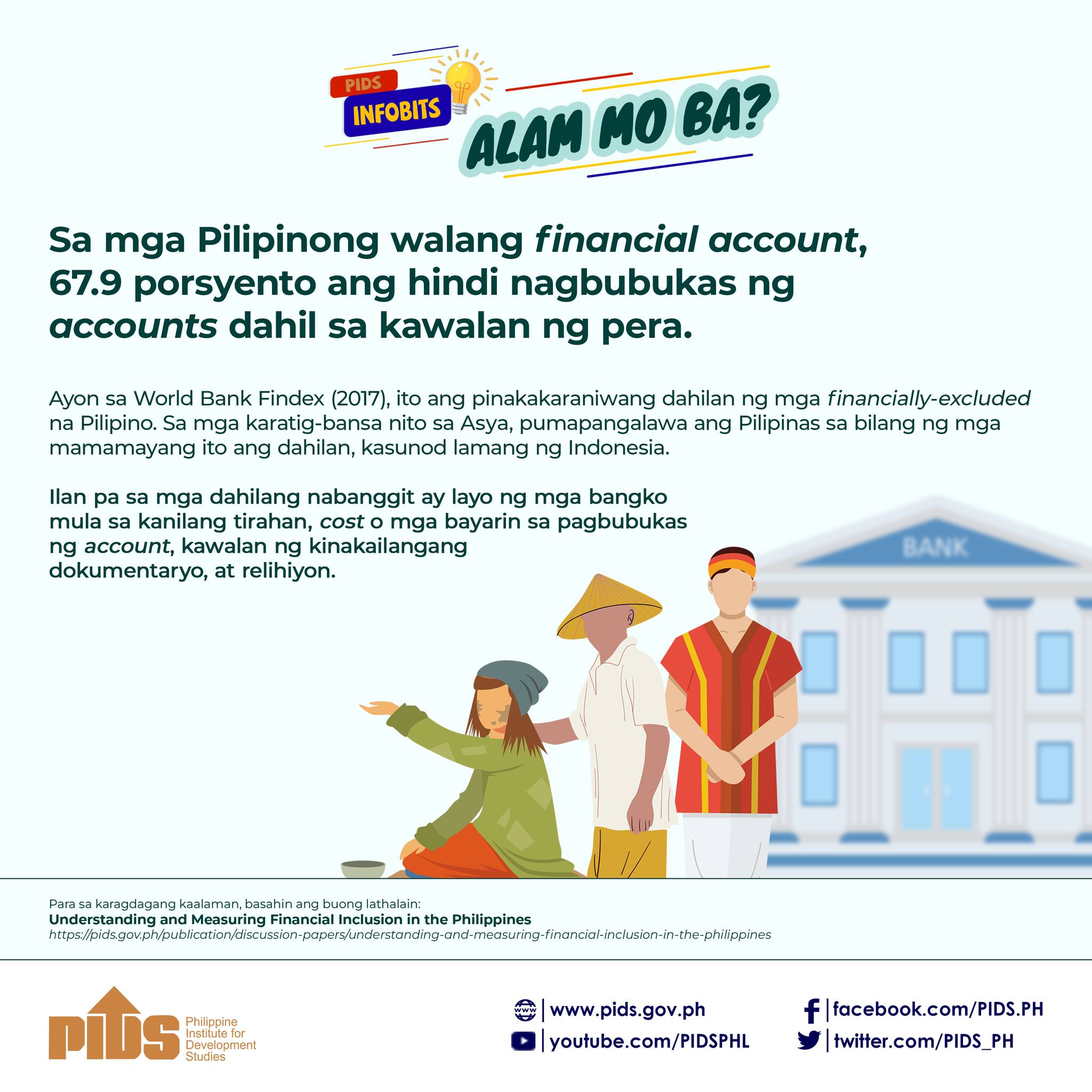

Several factors obstruct the growth of SMEs in the region but the foremost problem is the lack of access to financing as bank requirements on collateral and business plants are strict.

Unable to comply or sometimes lacking financial literacy, owners of small businesses are forced to rely on informal resources.

“SMEs simply do not have access to the capital they need to expand or participate in larges business and trading activities,” said ADB advisor Ganeshan Wignaraja.

The total credit gap of the difference between formal credit provided to SMEs and estimated financing needs for SMEs in ASEAN is currently placed at $52.8 billion.

In a recent forum organized by PIDS, experts from the Asian Development Bank (ADB), Department of Trade and Industry, Management Association of the Philippines and Financial Executives of the Philippines said despite the increasing contribution of SMEs to job creation in the region, their full potential has yet to be harnessed.

ADBs vice president for knowledge management and sustainable development Bambang Susanto said it is important to open access to finance and opportunities in the global value chain.

The ASEAN Economic Community (AEC) must build the physical connectivity of SMEs, raise their labor productivity and skills to standards of global value chains, and improve their access to finance, he said.

PIDS senior research fellow Erlinda Medalla said SMEs in the region must not only become a “vehicle for poverty reduction” but an engine of growth as well.

Several factors obstruct the growth of SMEs in the region but the foremost problem is the lack of access to financing as bank requirements on collateral and business plants are strict.

Unable to comply or sometimes lacking financial literacy, owners of small businesses are forced to rely on informal resources.

“SMEs simply do not have access to the capital they need to expand or participate in larges business and trading activities,” said ADB advisor Ganeshan Wignaraja.

The total credit gap of the difference between formal credit provided to SMEs and estimated financing needs for SMEs in ASEAN is currently placed at $52.8 billion.