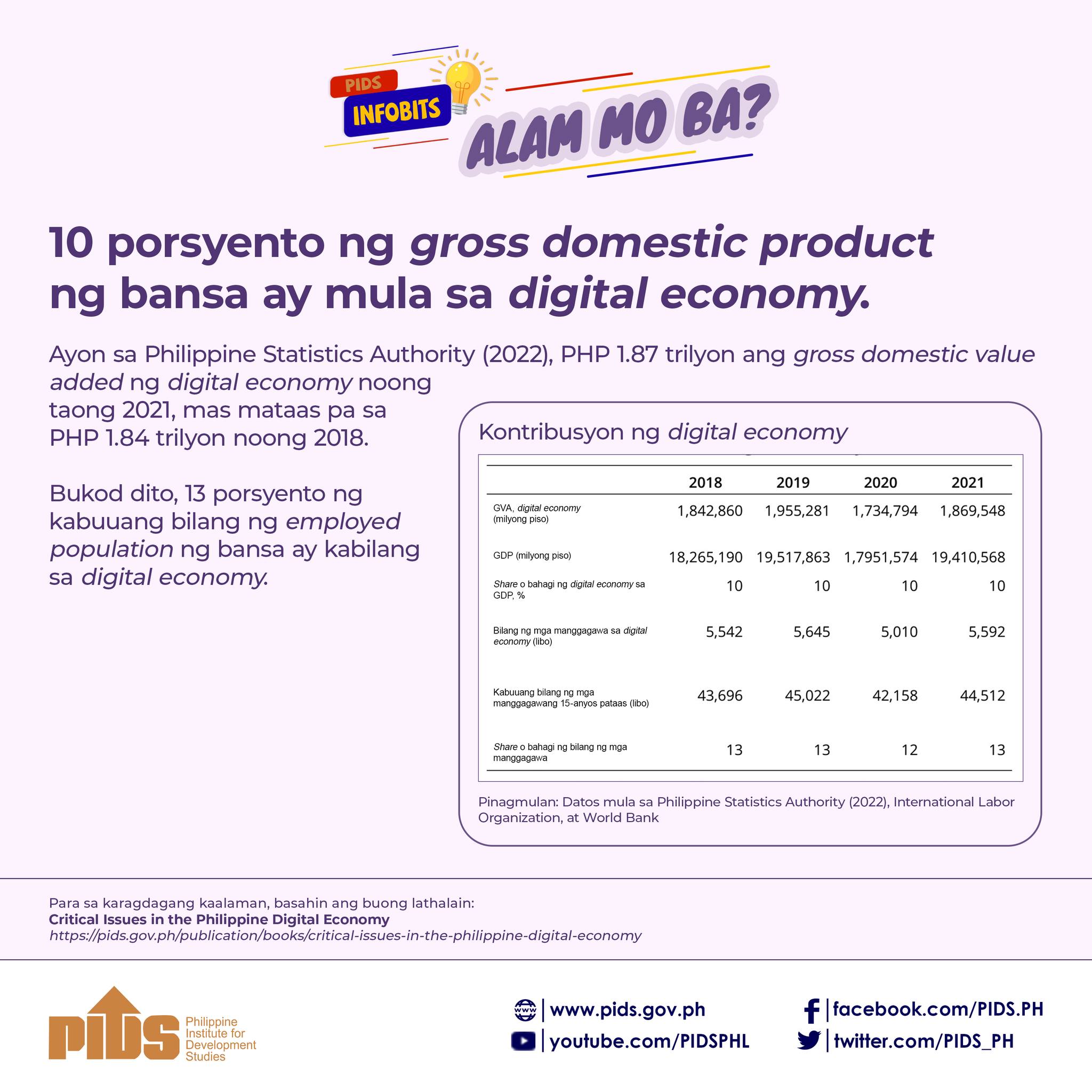

While the Philippines has existing laws that are “friendly” to digital platforms, some restrictive policies and regulations still hinder their growth in the country.

In a webinar recently organized by state think tank Philippine Institute for Development Studies (PIDS), Aiken Larisa Serzo, consultant at the Technology Law and Policy Program of the University of the Philippines Law Center, presented the findings of her studies that tackled cross-border regulatory issues in the country’s digital platforms.

Serzo, who is also the partner and head of the Fintech Practice at the Disini Buted Disini Law Offices, said there are “bright spots” in the country’s regulatory ecosystem that are beneficial to the growth of digital platforms, particularly in terms of innovation, facilitation of electronic transactions, payments and movement of funds, consumer protection, cybercrime and cybersecurity, intellectual property rights, and data protection and privacy.

However, the studies also revealed various restrictions that could affect the growth of digital platforms. One issue is the unclear classification of technology companies as value-added service providers (under telecommunication companies) that would require digital platforms, including mobile applications and software solutions, to register with the National Telecommunications Commission before they can operate. With this classification, digital platforms are also subjected to the 60-40 foreign equity restriction for public utilities.

In terms of investment policies, the study also identified various restrictions on foreign participation that apply to digital platforms. For one, the unclear definition of “mass media” classifies Internet platforms and businesses as such.

“Various pronouncements have set a rule wherein if you’re an internet business, communicating any message to the public, whether or not you’re the author of those messages, is mass media, and thus, subject to the foreign equity restriction of 100 percent,” Serzo explained.

Another challenge is the existence of regulatory overlaps due to the varying nature of technology products. This, according to Serzo, leads digital platforms to “fall under the jurisdiction of two or more regulators” that may have different sets of rules and requirements they need to comply with.

The expansion of digital platforms outside the country also faces the challenge of regulatory divergence regarding data privacy, as regulations for data transfer vary from one country to another.

“If you’re a platform, you must do some level of due diligence to identify what regulations apply to you and engage the services of a lawyer or compliance services in the jurisdictions where you operate,” Serzo said, noting that this increases the operational and compliance costs of digital platforms.

These regulatory restrictions have an impact on the ability of digital platforms to get funding. According to Serzo, while funding problem is a “regional phenomenon”, the Philippines is “still performing worse” than other Southeast Asian countries. Moreover, the compliance issues also affect the platforms’ desire to roll out products in the country.

Meanwhile, restrictive regulations lead to what Serzo called “regulatory arbitrage”, wherein firms relocate to other areas or jurisdictions where risk is more manageable.

Because of these impacts, Serzo urged the government to reevaluate the objectives behind restrictive policies and assess whether these are aligned with the country’s innovation policies and those issued by other intergovernmental organizations.

“For example, most of the investment restrictions we have were written decades ago and may have to be reconsidered in light of the existing technology these days and the fact that the harms that existed long ago may [no longer] be relevant today,” Serzo explained.

Moreover, Serzo also recommended a “wait-and-see-approach” for instances where “regulators want to study the technology but don’t want to hinder the innovation that could happen.” She said that it might be better to “issue best practices or guidelines instead of implementing ex-ante regulations” in some cases.

Gov’t urged to reevaluate PH restrictive regulations on digital platforms