Finance Sec. Carlos Dominguez has called for a serious rethinking of development banking strategies amid the challenge of making economies more inclusive in today’s world of ever-changing and disruptive digital technologies.

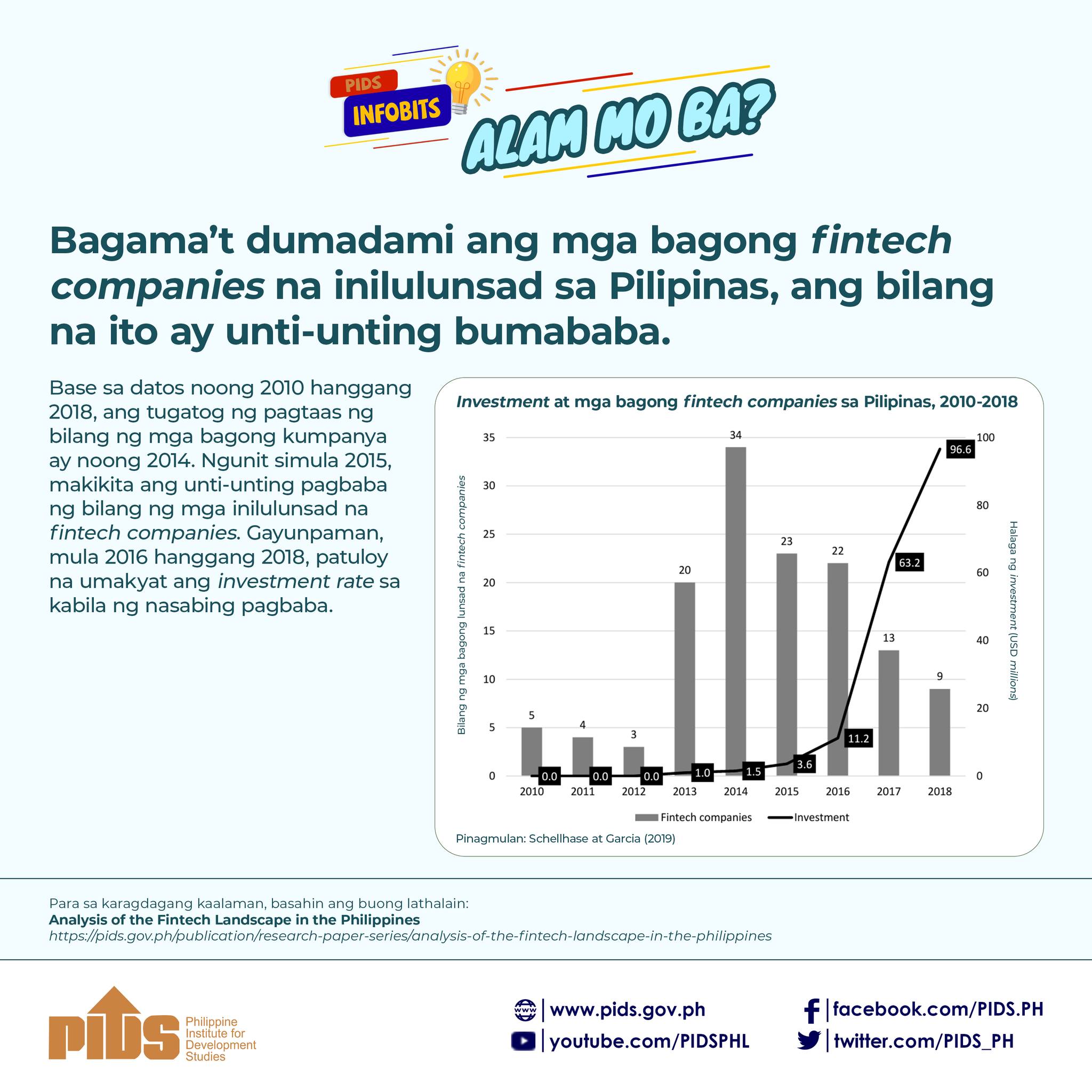

According to Dominguez, fintech or financial technology is one “dynamic area” that development banking policymakers should look into as new digital tools like e-payment systems speed up business transactions and make possible a more inclusive financial system.

Unless new disruptive technologies are harnessed to make institutions stronger, Dominguez said “they will overrun the way we govern our communities.”

He said new digital technologies, complemented by open borders, free trade and increased connectivity will change the way wealth is produced, shared and used.

But rather than fear the emerging digital chaos, governments should aspire to make technology-driven economies more inclusive, he said.

“We are at the dawn of a utopia driven by digital technologies. Autonomous vehicles, 3D printing and personalized medicine demand we alter the way we do things. Obsolete businesses die like dinosaurs, except at an even faster pace. New businesses will have to be imagined by the day,” said Dominguez in his closing remarks read for him by Finance undersecretary Antonette Tionko at the ‘Technology for Inclusion’ Conference held at the Asian Development Bank (ADB) headquarters in Manila.

“Welcome to this brave new world. In it we must rethink the way we do things, including what development banking should be doing,” Dominguez said.

The half-day conference held recently brought together leading policymakers, business leaders, and academics to discuss how new technologies, especially digital technologies, can be tapped to ensure more inclusive growth.

The forum serves as a lead-up event to the 51st Annual Meeting of the ADB board of governors hosted by the Philippines on May 3-6.

Dominguez said the discussions held at the conference make up only the beginning of more dialogues that should be done with the acceptance that today’s institutions must be reinvented lest they perish in this era of rapidly evolving technologies.

“The pace of technology-driven change will likely quicken. It alters the terms of our confederation. It instantly redefines the horizon. The challenge is to make this fast-paced technology-dictated change work to make human association better and our shared future brighter,” Dominguez said.

Dominguez said advances over the last 30 years in healthcare, education, communications and productivity that were principally driven by the digital revolution helped improve the average life expectancy by 11 years and reduce infant and maternal mortality rates, along with building a large middle class and rescuing hundreds of millions across Asia from absolute poverty.

“Yet this revolution has only just begun. Cloud computing, artificial intelligence and increasingly more powerful mobile technologies will alter the way we live and the way our economies are organized,” Dominguez said.

“Fintech is a particularly dynamic area. New digital tools such as e-payment systems enable us to speed up transactions and improve remittance processing. They make possible a more inclusive financial system,” Dominguez said.

According to studies, digitally driven financial inclusion using today’s fully developed technologies could increase gross domestic product (GDP) growth by three percent and raise income levels by 11 percent for the poorest, he noted.

Estimates likewise show that artificial intelligence could increase productivity by as much as 40 percent and increase global GDP growth by 25 percent by 2035.

Research made available earlier this year predict that in the Philippines alone, digital products and services will grow from just three percent of total economic output in 2017 to 40 percent by 2021.

“They could increase annual growth by half a percent,” Dominguez said.

ADB deputy chief economist Juzhong Zhuang opened the ‘Technology for Inclusion’ Conference, which began with a report on the highlights of the findings of the ADB’s ‘Asian Development Outlook 2018 Report on Technology and Jobs.’

The presentation of the Report’s findings by Yasuyuki Sawada, the bank’s chief economist, was followed by a discussion on how new technologies can be harnessed to create new jobs to replace the ones rendered obsolete by artificial intelligence.

ADB president Takehiko Nakao; Carolyn Florey, the technology for development lead of the International Rice Research Institute (IRRI); Akash Kaura, data scientist of LinkedIn; and Ambe Tierro, senior managing director of Accenture Philippines led the discussions.

Astrid Tuminez, the regional director for Microsoft Southeast Asia, talked about how technology can be used to benefit people and attain economic inclusion. Gary Gan, co-founder and CEO of JobKred Singapore; Jerome Ma, vice president of JingDong/JD.com; and Jane Thomason, CEO of Abt Associates-Australia joined the panel discussions on this pressing concern.

Prof. Reuben Ng of the Lee Kuan Yew School of Public Policy spoke on the role of government in ensuring a more inclusive digital revolution during the final session of the conference.

Jose Ramon Albert, senior research fellow of the Philippine Institute for Development Studies (PIDS); Shveta Arora, vice president and regional head for APAC/MEA, Infosys; and Soon Joo Gog, chief futurist and chief research officer of SkillsFuture Singapore served as panelists during the session. Some 3,000 to 4,000 delegates are expected to take part in the 51st Annual Meeting of the Asian Development Bank (ADB) scheduled on May 3-6 this year in Manila. Around 8,000 police officers were deployed to secure the ADB Annual Meeting.