The real estate sector has again shown its resilience during the present pandemic. A number of factors on both the demand and the supply side account for the sector’s resilient character.

The No. 1 positive factor on the demand side is the fact that shelter is one of the basic human needs. Every Filipino needs a roof over his or her head, whether that roof be a condominium unit or a house and whether it be owned or rented.

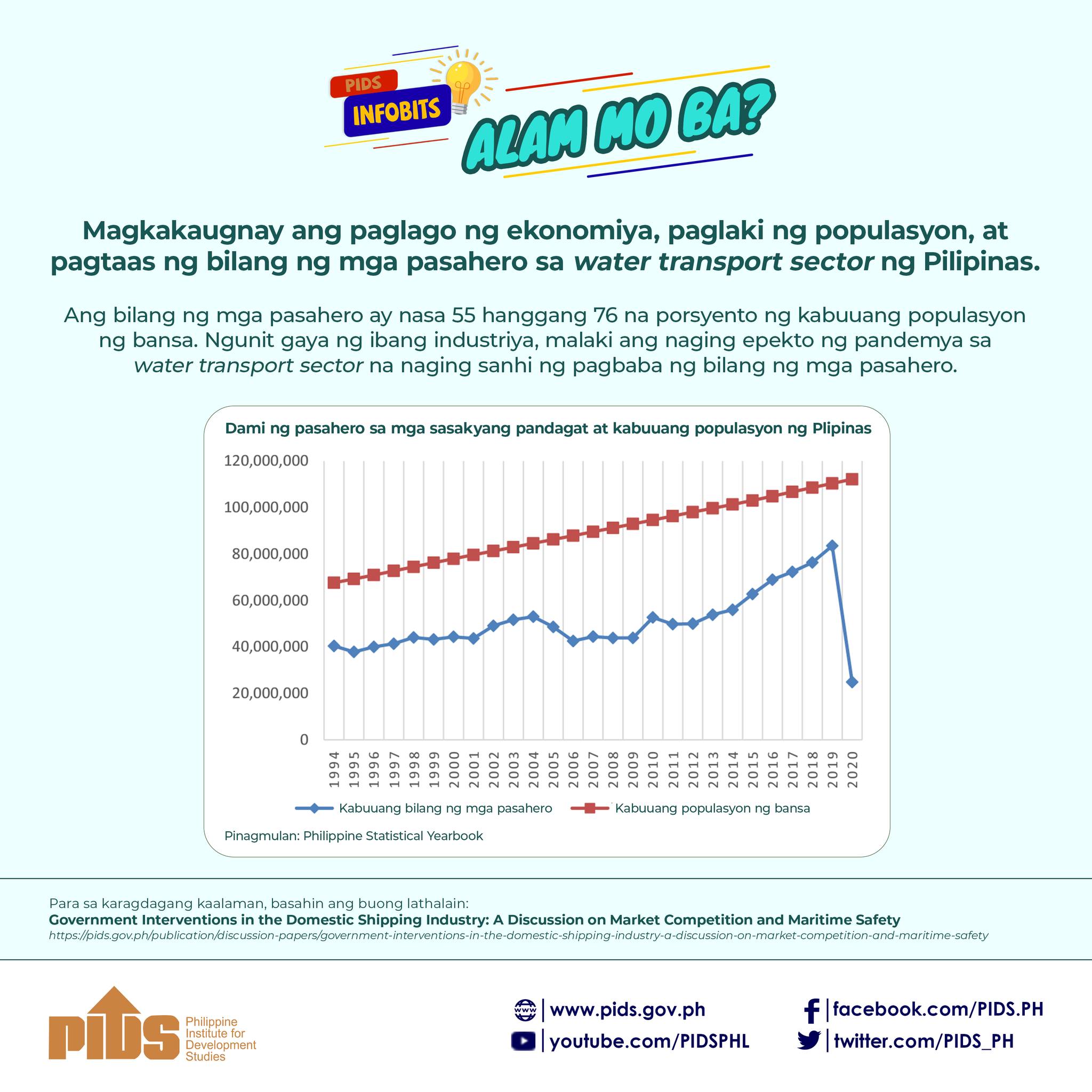

There is an enormous unfilled demand for residential units in the Philippines. NEDA and the National Housing Authority (NHA) have estimated the housing backlog at 6 million units. Over the years this total has not changed much because of the comparatively high growth rate of the Philippine population, placed by the Population Commission (Popcom) at 1.9 percent per annum.

The housing industry in the Philippines is accounted for by three income groups, namely the high-income group, the upper-middle-income group and the combination of the lower-middle-income group and the low-income group. Philippine Institute for Development Studies (PIDS) defines rich families as families with an indicative monthly income of at least P190,000; for poor families it is P9,520.

On the supply side, the explanation for the Philippine real estate sector’s resiliency lies in the availability of reasonably priced credit for most of the sector’s needs. The leading developers are well-capitalized, and are affiliated with major Philippine banks and have good track records with the investing public. The wealthy are, by definition, capable of financing their real estate acquisitions with their own resources, indeed the pre-selling of high-end residential structures has proceeded uninterruptedly during the lockdown.

The biggest slice of the real estate pie, in terms of both value and volume, is the slice pertaining to the upper middle-group of Filipinos. This slice has been financed largely by the billions of dollars sent home to their families by the millions of Filipinos working and living abroad—the Bagong Bayani. That inflow of funds has been steady over the years; in recent years the annual inflow has hovered around $2 billion, or around P100 billion. There have been fears of a massive repatriation of Overseas Filipino Workers (OFW), but the number of OFWs who have lost their jobs has been lower than projected. A number of banks have special programs for lending to upper middle-income borrowers for acquisitions of homes. The funds of these programs supplement the OFWs’ own funds.

The government has endeavored to make as much financing as possible available to housing for the poor—social housing—which accounts for the largest part of the housing backlog. The government financial institutions —Home Development Fund (Pag-IBIG), Social Security System (SSS) and Land Bank—offer special programs for social housing, but the amount of the needed financing is too much for the public sector to accommodate. But the huge demand is there, waiting to be filled either by private developers, with creative financing schemes, or by the government through a more determined social-housing financing policy.

The non-residential element of real-estate-sector resilience is the continued strong demand for space of the BPO (business process outsourcing) and POGO (Philippine offshore gaming outlet) industries. Such is the position that the Philippines now occupies in the world BPO industry that the BPO companies’ demand for space has hardly been affected by the long lockdown. However, the POGOs’ demand for space has declined lately partly because of the ban on international air traffic and partly because of issues with this country’s tax authorities. When the tax issues are satisfactorily resolved—progress is apparently being made —the POGO industry’s demand for space is bound to return to its former levels.

Apart from the basic market factors that consumers take into consideration when mulling the purchase of a product or service—especially factors relating to stability of value—real estate has in its favor attributes that make it a resilient investment option. The most important of these are real estate’s performance, durability, verifiability and superiority as loan collateral.

The superior price performance of real estate vis-à-vis other investment options was shown by the most recent Residential Real Estate Price Index (RREPI) of Bangko Sentral ng Pilipinas (BSP). At a time when the Philippine Stock Exchange Index (Phisix) is trying very hard not to get too far below the 7,000 mark and the prices indexes of petroleum and other commodities are displaying volatility, RREPI recorded, during the second quarter of 2020, the highest year-on-year growth in four years, i.e., since 2016’s first quarter when RREPI made its debut. The Q2 2020 growth rate was 27.1 percent.

Those index movements are reflected by the latest (October 2020) Global Housing Survey Report of the international real estate monitoring company LeadingRE (Leading Real Estate Companies of the World). Worldwide, LeadingRE reported a 68-percent increase (26 percent significant increase, 42 percent slight increase) in housing prices. In Asia-Pacific, one of the five regions into which LeadingRE has divided the world, the October 2020 Report recorded no-decrease situations in 48 percent of the regional markets (32 percent price increase; 16 percent prices holding up).

It makes sense that the sector that has displayed resiliency during the pandemic should lead the way in the economy’s coming recovery.