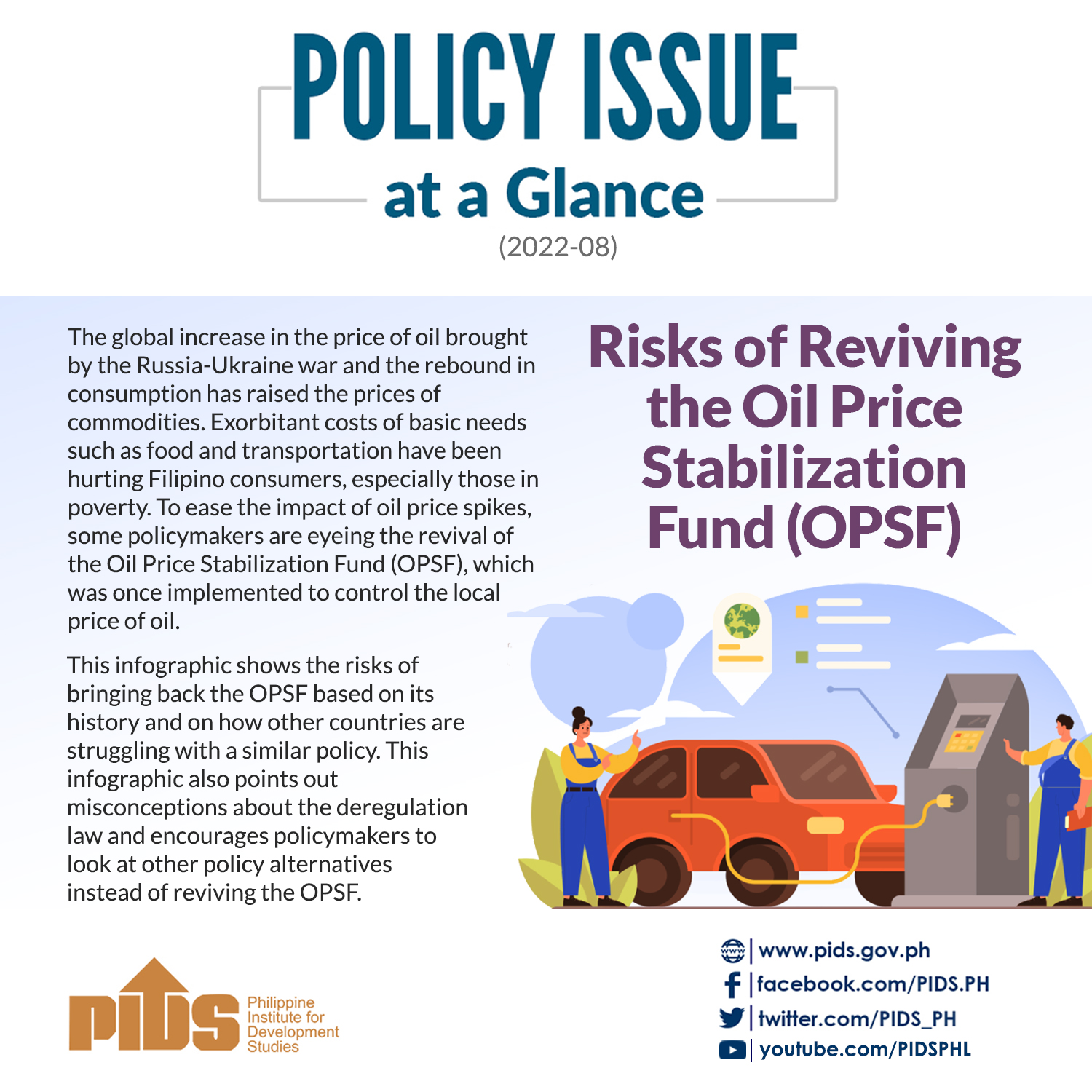

REVIVING the Oil Price Stabilization Fund (OPSF) is anti-poor, as the general public would end up subsidizing oil consumers through subsidies from the national budget, the semi-government think tank Philippine Institute for Development Studies (PIDS) said.

Instead, it said, several options that have been floated to blunt the impact of steadily rising fuel prices should be seriously reviewed and those feasible should be pursued.

In an online event on Thursday, the research firm said recent calls for the revival of the OPSF are tantamount to a reversal of the downstream oil industry deregulation.

Dr. Adoracion M. Navarro, senior fellow at PIDS and former undersecretary of the National Economic and Development Authority (Neda), said reform durability should be pursued instead of a policy reversal.

“This call for the revival of the OPSF is worrisome as it implies a reversal from the current deregulation policy regime to a highly regulated one. Price stabilization under an OPSF-like mechanism means the government will intervene and set prices that are stable or fixed during the regulatory price reset period,” she said.

Further, she explained that policymakers could also make additional commitments to stay the course through legislative amendments and supplemental issuances. Among the proposed legislative amendments are the proposals on minimum inventory requirement and retail price unbundling.

“Having a strategic oil reserve also deserves examination, which, if proven feasible and affordable, should be viewed as strictly a buffer during instances of severe oil supply disruption rather than as a regular price stabilization tool.

Lastly, having targeted assistance programs that facilitate direct income transfer to the poor is preferable to the OPSF and implementing these effectively is also a way to lock in reforms,” she said.

The Department of Energy’s Oil Industry Management Bureau Director Rino Abad said the agency is continuously looking for ways to cushion the recent oil price spikes due to Russia’s invasion of Ukraine.

of April 26 this year, the year-to-date net increases in domestic prices are P18.45 per liter for gasoline, P31.45 per liter for diesel, and P25.05 per liter for kerosene.

“The price unbundling policy was issued in 2018, but three courts issued an injunction against us so we were not able to implement it. Ultimately, we will find ways to implement this,” said Abad.

Meanwhile, the Philippine Institute of Petroleum (PIP) said the oil firms will continue to oppose the price unbundling, calling it a form of price control that will reverse deregulation.

The PIP also said that the proposed strategic petroleum reserve “needs more examination,” since there is no word yet if government is committed to funding and administering it.