The Philippines’ online gig economy has surged since the COVID-19 pandemic, but the rapid growth has drawn attention to the need for stronger social protections for digital workers.

A report from the Philippine Institute for Development Studies (PIDS) highlighted that while freelance earnings in the country increased by an impressive 208% between 2019 and 2020, online workers face significant challenges related to employment security and social benefits.

Queen Cel Oren, a PIDS research specialist, explained during a recent forum that despite the sector’s economic potential, freelancers and gig workers remain vulnerable.

“Online workers are also susceptible to risk and exploitation, such as oversupply of online workers, employment insecurity, discrimination, social isolation, overwork, psychological harm, free labor, and the race to the bottom wage rates,” Oren said.

Delivery riders, who are part of this expanding sector, echoed these concerns.

Mark Villanueva, a delivery rider in Iloilo City, shared the difficulties of being a gig worker.

“The flexibility is good, but we don’t have benefits like SSS or health insurance. If we get sick or hurt on the job, we’re on our own,” Villanueva said.

Oren pointed out that although flexible work arrangements provide opportunities for autonomy, they lack the standardized compensation and social protections seen in traditional employment. “The challenge for the government is how to ensure that online work adheres to decent work principles or ideals,” she added.

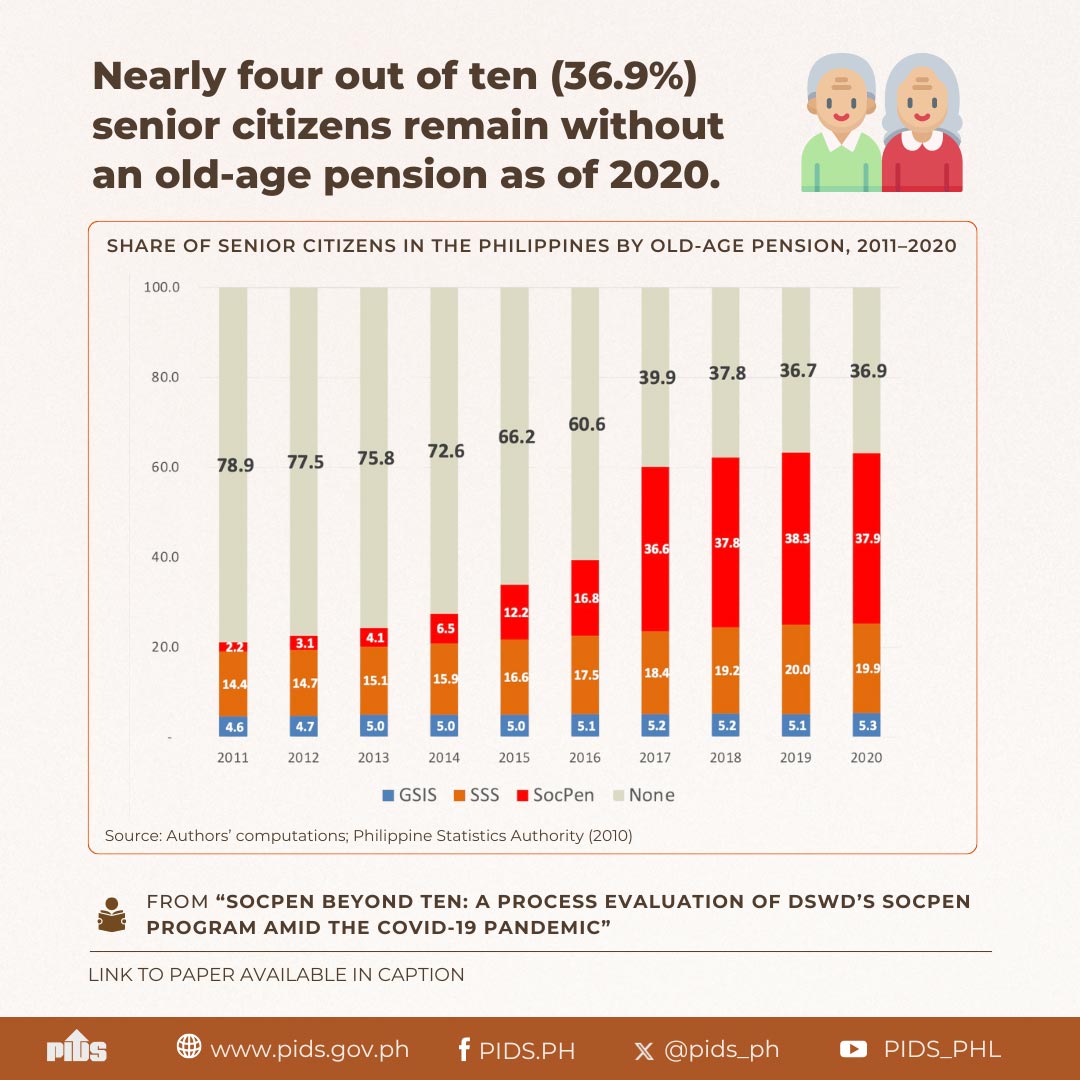

The report emphasized that online workers—including freelancers, independent contractors, and part-time workers—often operate outside the scope of existing social insurance programs like PAG-IBIG, SSS, and PhilHealth. To bridge this gap, Oren proposed reclassifying digital workers under broader membership categories to ensure their inclusion.

Policy Efforts and Legislative Gaps

While legislative frameworks such as the Freelance Workers Protection Act and the Magna Carta for Workers in the Informal Economy have been introduced, PIDS’ findings indicate that these measures fall short in effectively addressing the needs of gig workers. The report called for policy revisions to better align social protection and taxation systems with the realities of online work.