The country’s largest labor group on Wednesday said the government should first address the so-called unintended consequences of the implementation of Comprehensive Tax Reform Program (CTRP) on inflation before pushing for its Package 2.

At a news conference, Trade Union of Congress of the Philippines (TUCP) Vice President Luis Manual Corral said the economic managers were unprepared for the full impact of the TRAIN, which has boosted inflation to 4.5 percent in April or higher than the 2-percent to 4-percent inflation target for 2018.

“The economic managers [of the administration] should take a step back because we are telling them they creating a social problem. They are adding to the economic hardship of our people,” Corral said.

He said this could have been prevented had authorities first implemented the so-called tarrification of rice.

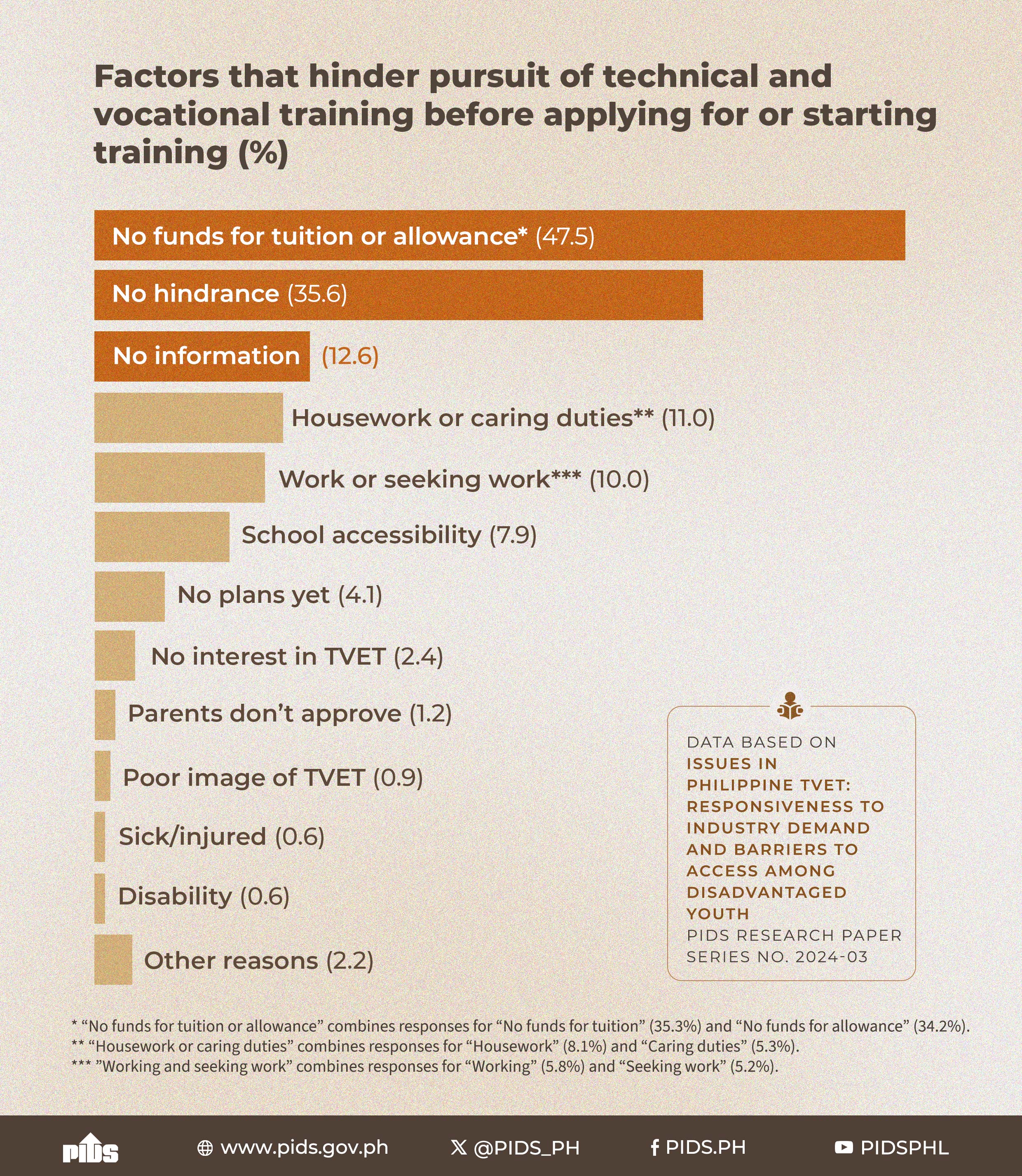

“The No. 1 increment for inflation for families in the D and E segments of the population is rice. About 20 percent of their income goes to rice,” Corral said, citing figures from the Philippines Institute for Development Studies (PIDS).

Based on its market monitoring, the TUCP said the different varieties of rice have already increased by 7 percent.

Under their proposed tariff measure, importation would no longer be under a government-to-government arrangement, but would instead be based on the initiative of the private sector.

“Some may criticize us why we are looking at market mechanisms. [That’s] simply because it is rational and will bring down the cost of rice to allow the private sector to import rice,” Corral said.

The TUCP said the decline in rice prices would “induce a positive shock on the disposable income of the poor.”

Corral said the government could generate P28 billion from rice tariffs.

He said the amount could be used to establish a Rice Competitiveness Enhancement Fund and boost the competitiveness of 1.3 million local farmers by providing technical support to move to high-value crop or to provide them with mechanized implements.

“The key here is that the process should be participatory because we believe that it is the farmer themselves who can identify the best use of the Rice Competitiveness Enhancement Fund,” Corral said.

To further arrest the rising inflation, Corral said the government should reduce electricity charges and provide subsidies to more workers affected by the CTRP.

“If they are able to address the issues on rice and electricity in the coming weeks, they could see its impact on the people by the next quarter,” Corral said.

Maintaining the status quo

THE TUCP made the statement amid the ongoing deliberation in Congress for Package 2 of the CTRP, particularly on lowering the corporate-income tax, from 30 percent to 25 percent, but removing the various tax subsidies and incentives on selected industries.

Corral said they oppose the measure because this might lead to a mass displacement of workers.

“We fear that radical change in the tax regime at this time may also cause locators currently operating in economic zones to look for better tax shelter arrangements in the Asean [Association of Southeast Asian Nations]. If these locators move, there is this real fear that jobs will be lost,” Corral said.

The TUCP said they expect the removal of tax incentives would mostly affect companies in the export sector.

The National Economic Development Authority (Neda), however, gave assurance on Tuesday the tax incentives should lead to minimal displacement, since only 4,000 companies avail themselves of it nationwide.

Pro-labor incentives

Instead of removing the tax incentives, Corral said the government could recast the requirements to include pro-labor policies like full employment and trade-union rights.

“The reality is, in these ecozones there, is so much violation of trade-union rights. There have been so many case of union busting, and if you are giving incentives to corporations, they have to give full employment and trade-union rights as well,” Corral said.

He said the conditions should include the number of their direct employees, contractual workers, presence of a productivity-incentive scheme, or a stock-dispersal policy.

“We are pushing for labor representation in the fiscal incentives review boards, which will be in charge of the kind of incentives that will remain for these industries,” Corral said. He said associating the tax incentives with labor-friendly companies is also in compliance to conditions set in the existing free-trade agreements with Europe and the United States.

“The continuation of our exporting of our goods to the United States and Europe is precisely tied with respect for these trade-union and labor rights,” Corral said.

The Neda earlier said it is already considering such reforms under the “rationalization” of the tax incentives.