The Philippine Institute for Development Studies (PIDS), a government think tank, has urged the creation of a national policy on shelter development as it called for a review of the housing incentives scheme noting that subsidies or tax perks for the low cost mass housing sector did not benefit the intended beneficiaries — poor and informal settlers — but rather the intermediaries.

PIDS senior research fellow Marife Ballesteros and PIDS senior research specialist Jasmine Egana on a study on the country’s housing problem noted that despite policy changes, the overall policy intervention remains wanting.

"The Philippines lacks a national policy on shelter development that integrates infrastructure, housing, and environmental concerns. The current approach to shelter is primarily on a per project basis instead of a city-wide shelter development. The absence of a city-wide approach creates difficulties for the national government and LGUs to address the housing problem on scale,” said Ballesteros.

In a study entitled "Fiscal costs of subsidies for socialized housing programs: An Update,” Ballesteros noted of a study of housing-related subsidies in the Philippines which estimated that a total of P25.4 billion in explicit and implicit subsidies was provided to the housing sector over the period 1993—1995.

"Fiscal costs from tax exemption through the guarantee program are lowest among other forms of subsidy,” Ballesteros said.

In an update, Ballesteros said that in 2009 alone, the government loss amounted to P278 million.

"This forgone income may not be necessary at all. Tax breaks are most likely captured by the intermediaries rather than the beneficiaries. It is also difficult to determine how these subsidies result in lower cost of housing for the beneficiaries,” she said.

According to Ballesteros, in an effort to reduce losses from financial transactions, government has further restricted financing to the low-income sector through lower exposure of funders and the higher loan ceilings on socialized and low-income packages. The government also continues to grant income tax holiday exemptions to low cost mass housing developers.

And yet, housing needs have ballooned to 5.7 million for 2011—2016 or over 1 million housing annually, with the need highest at the low end of the market.

"Clearly, the current subsidy system does not address the objectives of the National Shelter Program,” the study said.

Subsidy interventions in the financial system should be focused on low- to middle-income households or those who are able to fulfill obligations resulting from small loans. Subsidy can be provided through a point system that rewards the need for housing and savings effort.

The demand subsidies should be portable, allowing families to select their housing in terms of type of property, location, and other characteristics. The subsidy is given to the household, not to the developer or financial entity.

The poor with incomes below minimum wage and those with incomes that are 1.5 to 3.5 times the minimum wage require other types of intervention. Most likely, these are through different types of public housing arrangements such as NHA housing and rental arrangements, among others.

Lowering the cost of housing should be done outside of the financial intermediation process. Government should avoid large potential future fiscal liabilities such as unfunded pension liabilities or bailouts of failed housing finance institutions, the study said.

The current housing subsidy arrangements such as the use of contractual savings for below-market interest rates, guaranteed take-outs of developers, and tax exemptions may stimulate private sector investment in low-cost housing but would not address the issues of access and affordability for the low-income sector.

The current housing subsidy arrangements such as the use of contractual savings for below-market interest rates, guaranteed take-outs of developers, and tax exemptions may stimulate private sector investment in low-cost housing but would not address the issues of access and affordability for the low-income sector.

If the objective is to improve affordability levels, the study said that direct or upfront subsidies would have greater impact. Latin American countries moved away from similar low-cost contractual savings lending schemes to a demand subsidy mechanism.

Among the key lessons that are worth considering for the Philippines are:

The housing finance subsidy should be a transparent amount that may be budgeted and with government commitment in terms of amount and continuity of resources. Chile, Colombia, and Costa Rica dedicated more than 1 percent of government budget in maintaining temporal continuity in the long term.

Subsidy interventions in the financial system should be focused on low- to middle-income households or those who are able to fulfill obligations resulting from small loans.Subsidy can be provided through a point system that rewards the need for housing and savings effort.

In 2011, the government released PHP 50 billion to the newly formed National Informal Settlement Upgrading System Program for informal settlers living in perilous areas in Metro Manila. Two years later, two major policy reforms were adopted due to the slow pace of its implementation.

First was the National Housing Authority (NHA) Enhanced Resettlement Package that increases the maximum cost of socialized housing units for off-city and in-city resettlements in order to build bigger and more disaster-resilient houses.

Second was the expansion of the financing program of the Socialized Housing Finance Corporation to include high-density housing (HDH). The HDH addresses the problem of limited land for socialized housing in urban areas by accommodating more families per unit of land which also promotes building of better houses and improved access to basic facilities and infrastructure.

Despite these policy changes, the PIDS research showed more housing issues ensued in urban areas.

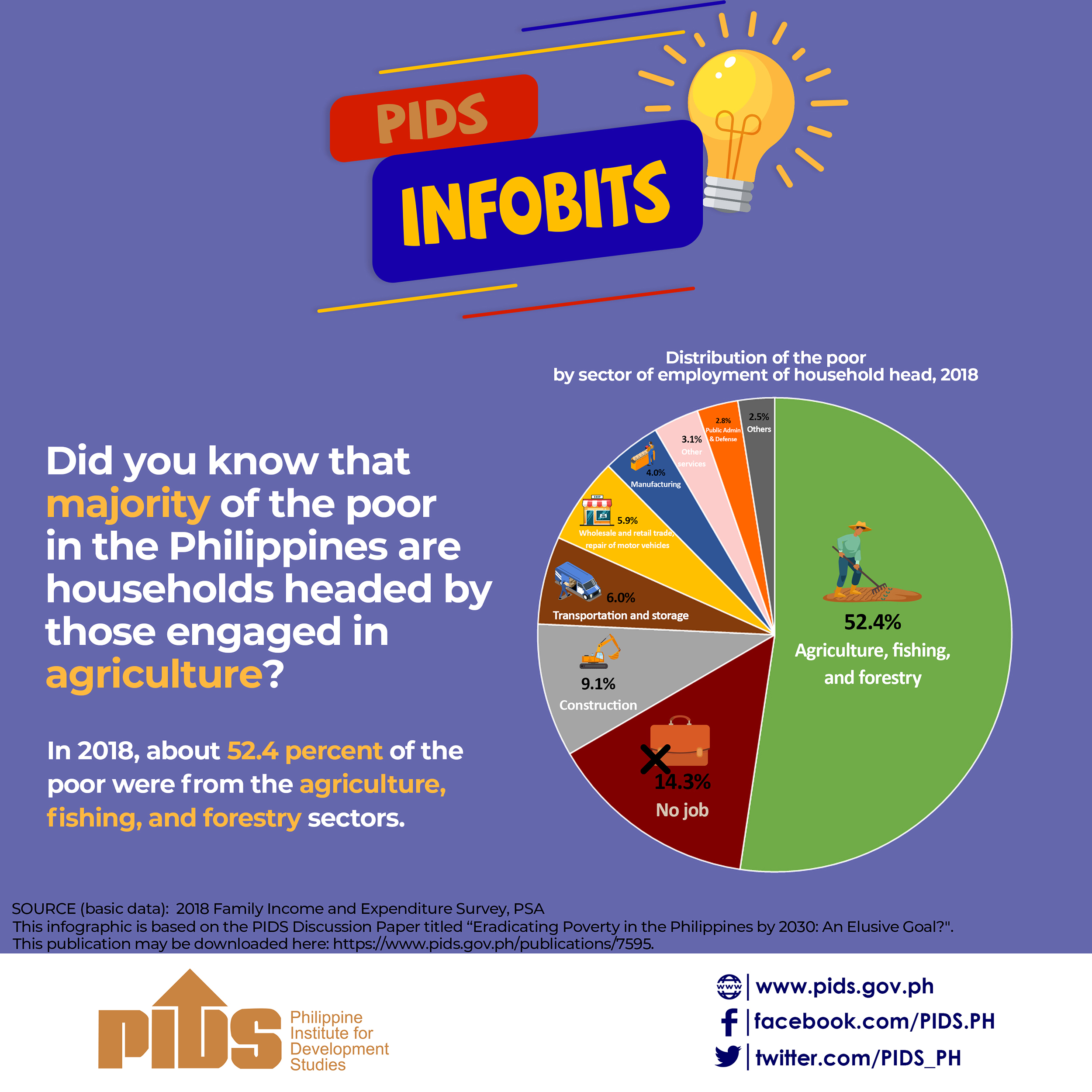

"Decent living spaces are a critical issue among the poor especially in urban areas. Many of them resort to informal or illegal housing, living in shanties, occupying other people’s land, or squatting in the most unsanitary places unimaginable such as riverbanks, streets, and bridges,” the study showed.

Inequalities in shelter deprivation and access to basic services are most evident particularly in cities where wealth and poverty exist in close proximity.

Metro Manila alone is home to more than 4 million slum dwellers threatened by adverse congestion, substandard housing, and deteriorating environment.

Relocating informal settlers and victims of natural and human-induced disasters to safer areas is a critical challenge in the housing sector. The adverse impacts of climate change has made the relocation of families living in danger zones more urgent.

Natural disasters also induce further relocation to cities, which can increase informal settlements.

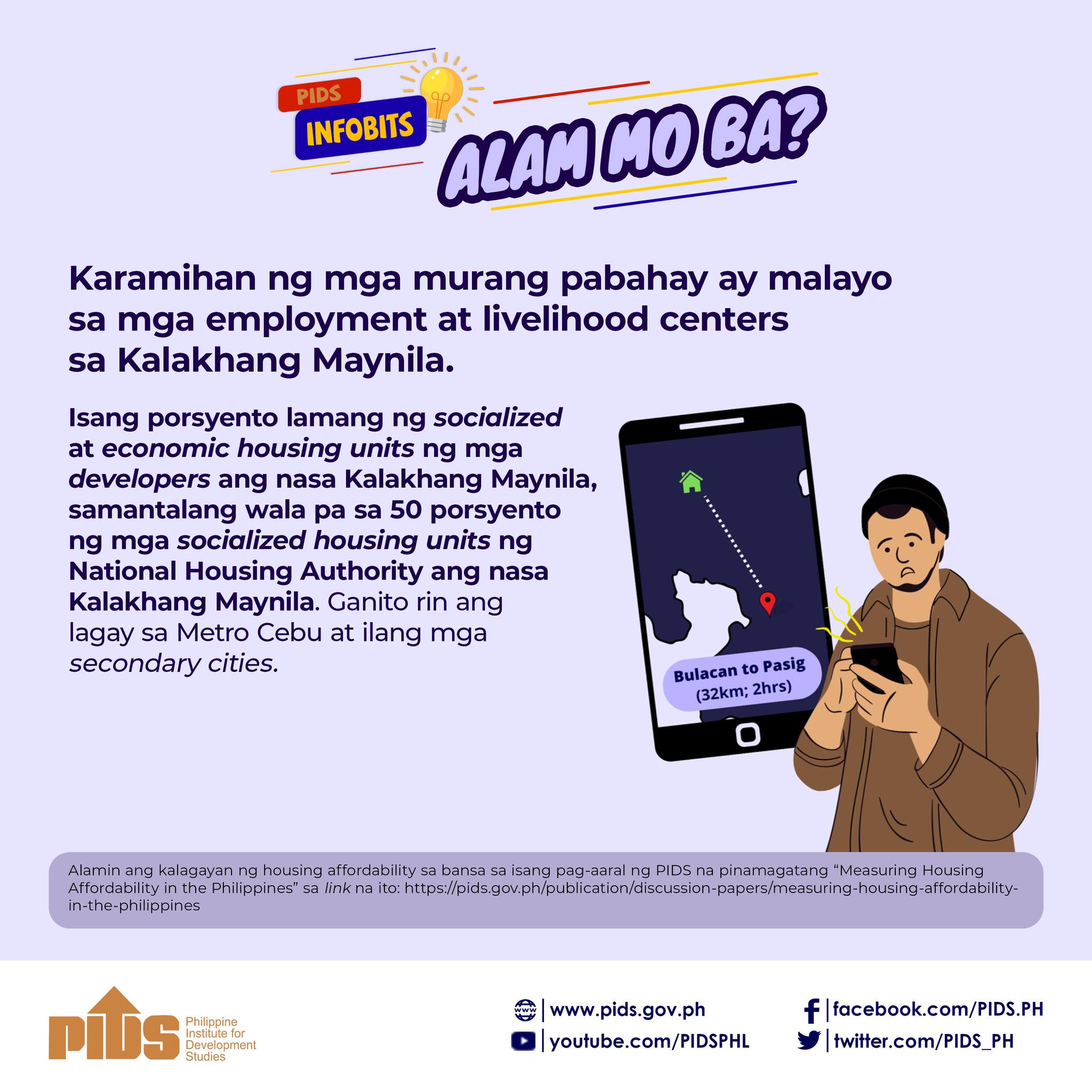

The study also showed that in-city housing projects, despite their higher costs compared to off-city projects, are most cost effective.

In-city housing has higher long-term benefits given better chances of finding employment and more income-generating opportunities. The availability of land for relocation projects, however, is a crucial problem.

For resettlement programs to be effective, land for socialized housing has to be made available by local governments or the national government especially in urban areas like Metro Manila. The authors also emphasized the need to study the feasibility of vertical development in in-city housing and for the NHA to improve the production process for incremental housing.

Ballesteros has proposed policy notes has proposed some policy notes including creation of a database system at the local level to identify beneficiaries.//