Taxation - Matches

Showing 16-30 of 36 items.

The Philippine Institute for Development Studies conducted a public seminar to disseminate its research outputs on the government's Tax Reform for Acc..

Photos - Seminars

This Policy Note analyzes the taxes imposed by the Tax Reform for Acceleration and Inclusion (TRAIN) Act and their impact on the liberalization thrust..

Policy Notes

Eight well-known economists urged Congress to pass the corporate tax reform bill to help fulfill the government’s goal of making the country&rsq..

In the News

As the two houses of Congress consolidate their respective bills containing the first tax reform package, civil society groups on Monday called for th..

In the News

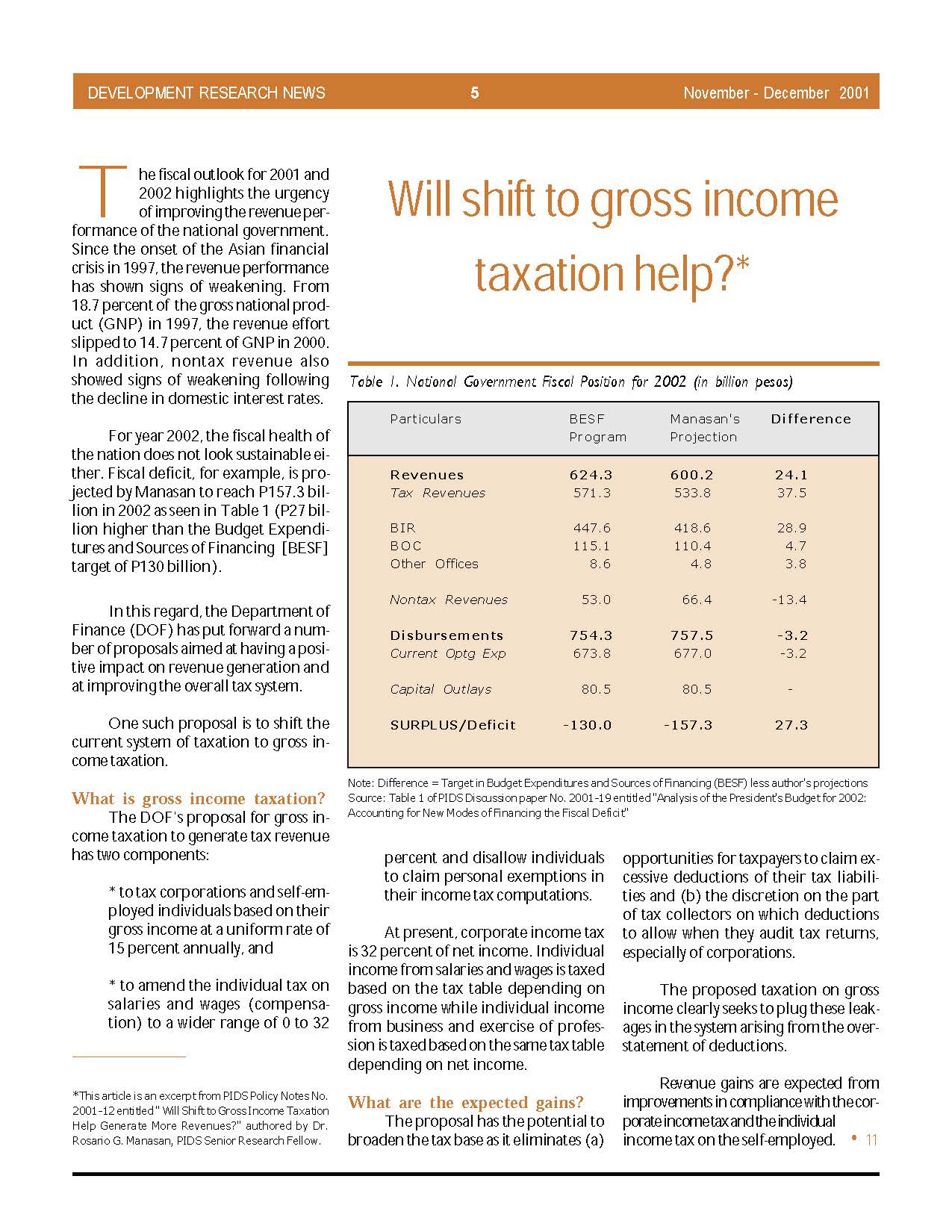

Proposals to reform the personal income tax has gained prominence in recent months. To date, personal income tax reform is part and parcel of the plat..

Events

Effective governance leads to economic growth. State think tank Philippine Institute for Development Studies (PIDS) President Gilberto Llanto said tha..

Press Releases

This paper examines the country's investment incentive program for foreign investors and its success in attracting substantial FDI inflows. The analys..

Research Paper Series

This paper examines the country’s investment incentive program for foreign investors and its success in attracting substantial FDI inflows. The anal..

Discussion Papers

Have the reforms in the country's tax structure through the years helped in improving taxpayer compliance? What has been the trend in tax evasion in r..

Policy Notes

This issue suggests the need to give greater attention to and care in using tax expenditure policy to achieve several conflicting objectives. An under..

Policy Notes

Through the provision of the Local Government Code, transfer of responsibilities from the national to the local level has been instituted. This paper ..

Philippine Journal of Development

From the administrative and policy perspective, determination of magnitude of tax evasion and an analysis of tax evasion levels are imperative so that..

Philippine Journal of Development

This study analyzes the effect of the interaction between domestic indirect taxes and tariff system to the market of particular goods. Computation of ..

Philippine Journal of Development

Utilizing tax buoyancy and tax elasticity, this study evaluates the performance of the Philippine tax system from the perspective of tax mobili..

Staff Papers

Showing 16-30 of 36 items.