Excise tax - Matches

Showing 1-10 of 10 items.

This Policy Note discusses the impacts on poverty and employment of the increased fuel excise tax rates under the first package of the Tax Reform for ..

Policy Notes

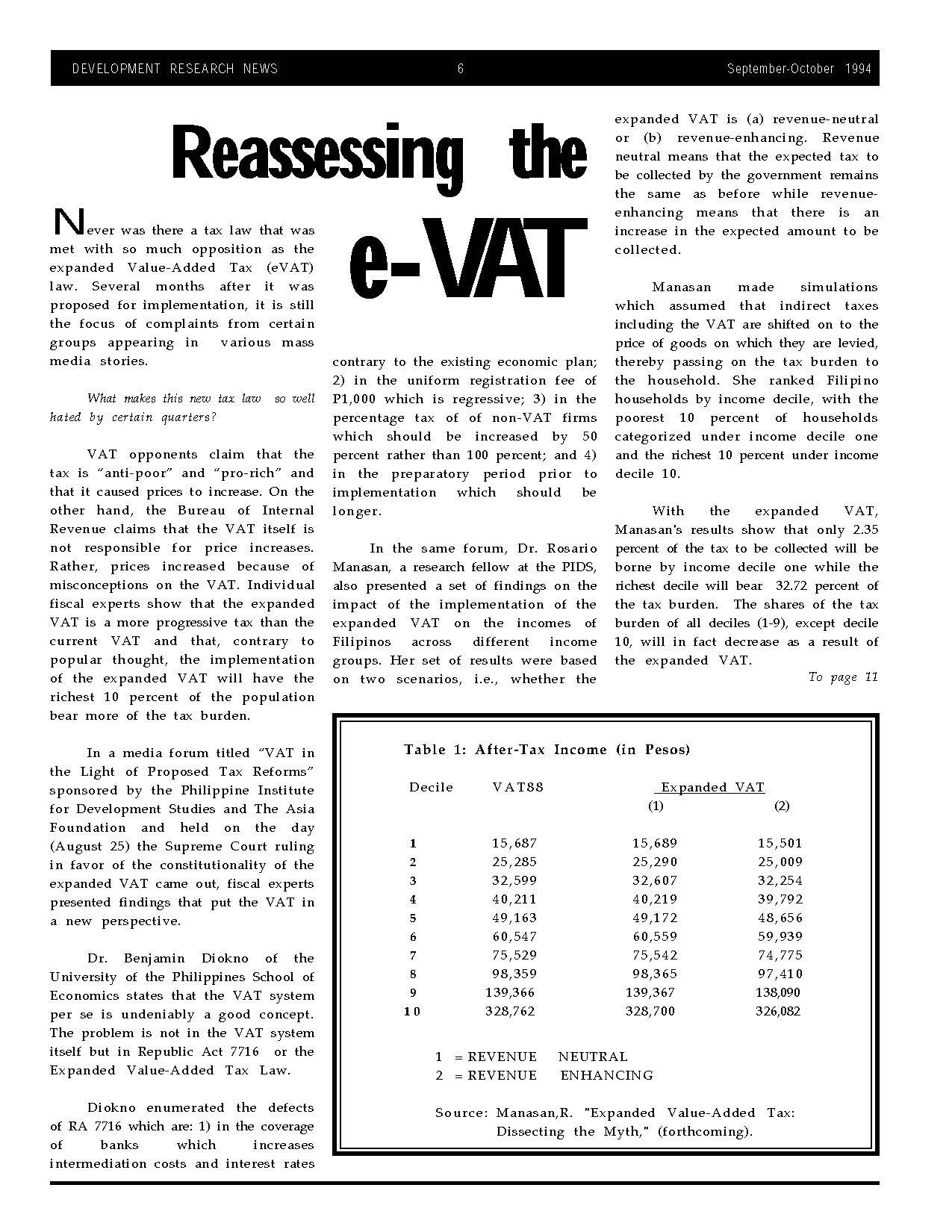

In January 2018, the first package of the Tax Reform for Acceleration and Inclusion (TRAIN) Law took effect, adjusting, among others, the excise tax r..

Policy Notes

The study assesses the impact of the first package of the Tax Reform for Acceleration and Inclusion (or TRAIN), which includes an increase in petroleu..

Discussion Papers

Package 1 of the Duterte administration’s tax reform program was enacted into law as RA 10963, otherwise known as the “Tax Reform for Acceleration..

Discussion Papers

The self employed and professionals, or SEPs, will get no benefit from the government’s tax reform program which is now under considation by the..

In the News

A new tax reform can only be effective if the proposed bill of the government is approved in its entirety, according to the Philippine Institute for D..

In the News

Despite various reform efforts over the years, the tax system in the Philippines continues to suffer from chronic weaknesses. The Duterte administrati..

Discussion Papers

Proposals to reform the personal income tax have gained prominence in recent months. To date, personal income tax reform is part and parcel of the pla..

Discussion Papers

The amendment of the existing excise tax law on tobacco and alcoholic products is the only revenue measure that the Aquino administration has certifie..

Discussion Papers

Showing 1-10 of 10 items.